link here to article

Bill Gates has advocated improvements in the teaching of science and math. Steve Jobs has argued that the humanities have been key to success of Apple. Wesleyan University has been an advocate of a broad liberal arts education which includes science and the humanities. The President of Wesleyan argues that both are platforms, rather than specific skills, and that the PC and the Mac are really platforms that have been behind the success of both companies. They both have led to complementary developments that have enriched their companies.

Thursday, March 31, 2011

What Explains the Decline in Business Investment?

A conservative economist has received a lot of attention from a graph that he published on his blog showing that unemployment is correlated with the decline in business investment. He explains this relationship by arguing that job loss is due to government over-regulation which has affected business confidence and the fall in business investment. What does the correlation explain, however?

Business investment is a broad concept that includes residential real estate investment as well as business investment in plant and equipment. When the business investment data are decomposed it is apparent that investment in plant and equipment is similar to what it was in the same stage of the modest recession in 2001. The big change in business investment has been the busting of the housing bubble. The resulting recession, of course, has cut into consumption and business has done what it always does when consumption falls. It burns down inventory and it puts off investment in plant and equipment.

John Taylor is a smart guy and he knows that business investment includes residential real estate investment. Its hard to understand why he explained the relationship between business investment and job loss the way that he did. It makes sense, however, when we relate it to ideology. Conservative economists have a propensity to explain almost every economic problem on the same enemy. The government, and not the market economy, is always the cause of our economic problems. This was true of the Great Depression and it is the conservative explanation of the Great Recession and high unemployment.

Is the Fed Still too Close to the Banks that They Regulate?

link here to article

We recently posted an article on the reported profits in the financial sector. This article raises questions about the reported profits and, more importantly, about the priorities of those who are supposed to be regulating the banks. The editorial claims that the reported profits may have been inflated by downward revisions to future losses from bad assets that they hold. Since many of those bad assets are in real estate securities the downward revisions may not accurately reflect bank exposure to loss as housing prices continue to fall, and bank penalties for dealing with foreclosures improperly have not been decided. Allowing banks to pay out dividends, and to buy back stock shares, is a way to reward bank executives and other shareholders. It also reduces the cushion that banks may need if they underestimate future losses and penalties.

We recently posted an article on the reported profits in the financial sector. This article raises questions about the reported profits and, more importantly, about the priorities of those who are supposed to be regulating the banks. The editorial claims that the reported profits may have been inflated by downward revisions to future losses from bad assets that they hold. Since many of those bad assets are in real estate securities the downward revisions may not accurately reflect bank exposure to loss as housing prices continue to fall, and bank penalties for dealing with foreclosures improperly have not been decided. Allowing banks to pay out dividends, and to buy back stock shares, is a way to reward bank executives and other shareholders. It also reduces the cushion that banks may need if they underestimate future losses and penalties.

A Book on Bill Gates that Has the Feel of the Movie "Social Network"

link here to article

This article (Via Manan Shukla who has been reading a lot) describes the relationship between Bill Gates and Paul Allen who was one of the co-founders of Microsoft. One part of the story is about Allen's resentment over a plot between Gates and Balmer to dilute Allen's share of Microsoft stock. This was one of the plots in "Social Network". Allen is worth around $9 billion today and he has been successful in several areas. He is also a big philanthropist. Its amazing, however, how things that affected him a long time ago have been festering in Allen's mind so much that he decided to make them public.

This article (Via Manan Shukla who has been reading a lot) describes the relationship between Bill Gates and Paul Allen who was one of the co-founders of Microsoft. One part of the story is about Allen's resentment over a plot between Gates and Balmer to dilute Allen's share of Microsoft stock. This was one of the plots in "Social Network". Allen is worth around $9 billion today and he has been successful in several areas. He is also a big philanthropist. Its amazing, however, how things that affected him a long time ago have been festering in Allen's mind so much that he decided to make them public.

What Does the Possession of a US Passport Tell US?

link here to article

This article (Via Manan Shukla) provides some fascinating data on the relationship between the possession of a US passport and a host of other variables among US citizens. There is a wide difference between states in the ratio of passport holders and it correlates with the voting patterns of the states. We would expect richer states to have a higher ratio of passport holders but many of the correlations hold even when corrected for income.

This article (Via Manan Shukla) provides some fascinating data on the relationship between the possession of a US passport and a host of other variables among US citizens. There is a wide difference between states in the ratio of passport holders and it correlates with the voting patterns of the states. We would expect richer states to have a higher ratio of passport holders but many of the correlations hold even when corrected for income.

More Bad News for Ireland's Banks and the Country

link here to article

This article (Via Manan Shukla) paint an even bleaker picture of Ireland's financial crisis than some of our previous posts on problems in Ireland. It is a story of a banking system which is to big to save. The iIrish economy is not big enough to absorb the losses suffered in the banking system. The banks borrowed heavily from banks, especially German banks, in Europe and the government guaranteed the debt. The problem is that the Irish economy is small relative to the total debt burden that the banks and the government have assumed.

This article (Via Manan Shukla) paint an even bleaker picture of Ireland's financial crisis than some of our previous posts on problems in Ireland. It is a story of a banking system which is to big to save. The iIrish economy is not big enough to absorb the losses suffered in the banking system. The banks borrowed heavily from banks, especially German banks, in Europe and the government guaranteed the debt. The problem is that the Irish economy is small relative to the total debt burden that the banks and the government have assumed.

Wednesday, March 30, 2011

Right Wing Funding of Tea Party Tactic to Kill Healthcare Reform

link here to article

This article describes how a right wing group from Texas is trying to have states take over healthcare as a way to kill it. The question that occurs to me is why a typical Tea Partier, who is dependent upon someone in their family receiving Medicare of Medicaid benefits would want to do this. The only benefit goes to those who want to limit taxes or the ability of government to support those in need.

This article describes how a right wing group from Texas is trying to have states take over healthcare as a way to kill it. The question that occurs to me is why a typical Tea Partier, who is dependent upon someone in their family receiving Medicare of Medicaid benefits would want to do this. The only benefit goes to those who want to limit taxes or the ability of government to support those in need.

This Could Describe Many of those in the Tea Party

link here to article

I couldn't resist this post. It says a lot about the folks who go around saying how much they love their country. They really hate everything that is not part of their arrested development.

I couldn't resist this post. It says a lot about the folks who go around saying how much they love their country. They really hate everything that is not part of their arrested development.

GOP House Votes to End HAMP Program

link here to article

The HAMP program has been a failure and the GOP decided to reming voters that it has failed. The House voted to terminate the program even though it will not be approved by the Senate. They did not propose anything to replace the program so they did little to help the home owners who they claimed to be so concerned about in their debate. Its all about 2012 elections.

The HAMP program has been a failure and the GOP decided to reming voters that it has failed. The House voted to terminate the program even though it will not be approved by the Senate. They did not propose anything to replace the program so they did little to help the home owners who they claimed to be so concerned about in their debate. Its all about 2012 elections.

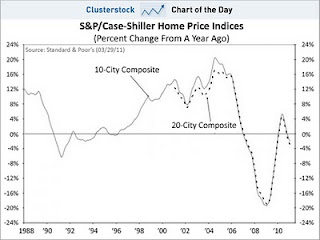

Housing Prices Begin Decline Again

This graph shows that housing prices in the US have begun to decline after it appeared that they had begun to recovery. This probably reflects the increased sale of foreclosed homes which are sold at distressed prices. This result reinforces the point made by the Inspector General's report on the TARP program below. Government has done little to prevent the decline of home prices and to preserve home ownership which was one of the goals of TARP.

Inspector General of TARP Critical of its Performance

link here to article

The Inspector General agreed with the governments assessment of the TARP program's performance in rescuing the Wall Street banks. The largest banks are 20% larger than the were before the crisis and they are back to pre-crisis levels of profits. They remain "too big to fail" and because investors do not have to worry about defaults, they can borrow money at rates below those available to smaller banks. If the Treasury Departments goal was to preserve Wall Street it has been a huge success.

The report argues, however, that the other objective of TARP has been a big failure. Congress passed the TARP legislation with the assurance that TARP would purchase mortgages from homeowners in order to preserve home ownership and protect home values. The HAMP program, under the direction of Treasury, was a big flop.

Furthermore, Treasury has resisted real efforts to reform Wall Street. The banks have been restored to their prior dominance of the economy at the expense of Main Street and little has been done to keep them from creating the next crisis. It appears, the the Inspector General that, Treasury, which is staffed extensively with former Wall Street bankers, shares too many of the values of the banks that they came from.

The Inspector General agreed with the governments assessment of the TARP program's performance in rescuing the Wall Street banks. The largest banks are 20% larger than the were before the crisis and they are back to pre-crisis levels of profits. They remain "too big to fail" and because investors do not have to worry about defaults, they can borrow money at rates below those available to smaller banks. If the Treasury Departments goal was to preserve Wall Street it has been a huge success.

The report argues, however, that the other objective of TARP has been a big failure. Congress passed the TARP legislation with the assurance that TARP would purchase mortgages from homeowners in order to preserve home ownership and protect home values. The HAMP program, under the direction of Treasury, was a big flop.

Furthermore, Treasury has resisted real efforts to reform Wall Street. The banks have been restored to their prior dominance of the economy at the expense of Main Street and little has been done to keep them from creating the next crisis. It appears, the the Inspector General that, Treasury, which is staffed extensively with former Wall Street bankers, shares too many of the values of the banks that they came from.

Tuesday, March 29, 2011

A Conservative's View of the US as Greece

link here to article

Greg Mankiw is a conservative economist who, for a brief interval, was the head of Bush's Council of Economic Advisors. In this article he paints a picture of the US in which it looks pretty much like Greece looks today after years of poorly running its economy.

Investors will only invest in US debt at very high interest rates and interest payments become a very large part of the total budget.

The US, like Greece, will be forced to accept austerity as a fact of life. Taxes will have to be raised and government entitlement programs will have to be drastically cut or eliminated for many Americans. Just to amplify his message, the IMF is now located in China, which reflects its loss of economic power and influence.

Mankiw is correct about a couple of things. Our political system has failed us in several ways. It has been easier to win elections by providing tax cuts that are paid for with debt and not with cuts in spending. We have the lowest ratio of taxes to GDP of any OECD countries as a result. Most of this occurred under the Reagan and Bush Jr. administrations which he does not mention. We also have failed to deal with the rising cost of healthcare as he mentions. The Obama reform plan does have cost reduction aspects in it, but the GOP is doing what it can to neuter the plan. Mankiw only mentions the rising costs of new technology as the driver of healthcare costs. This is a factor but it is only one of many. Every industrial economy is using new technology as it becomes available, but most are able to provide universal coverage and excellent healthcare at half the per capita cost than the US. They have more efficient systems of delivering healthcare and containing provider price inflation.

Lastly, the US is not like Greece in many respects. It is not likely to encounter problems in the future that are anything like Greece faces. Presumably, Mankiw wrote this article to encourage us to thinks about changes that we need to make today in order to provide a better future for future generations. The message that he delivered appears to be more consistent with conservative efforts to frighten Americans about the future as a result of overspending by government.

Greg Mankiw is a conservative economist who, for a brief interval, was the head of Bush's Council of Economic Advisors. In this article he paints a picture of the US in which it looks pretty much like Greece looks today after years of poorly running its economy.

Investors will only invest in US debt at very high interest rates and interest payments become a very large part of the total budget.

The US, like Greece, will be forced to accept austerity as a fact of life. Taxes will have to be raised and government entitlement programs will have to be drastically cut or eliminated for many Americans. Just to amplify his message, the IMF is now located in China, which reflects its loss of economic power and influence.

Mankiw is correct about a couple of things. Our political system has failed us in several ways. It has been easier to win elections by providing tax cuts that are paid for with debt and not with cuts in spending. We have the lowest ratio of taxes to GDP of any OECD countries as a result. Most of this occurred under the Reagan and Bush Jr. administrations which he does not mention. We also have failed to deal with the rising cost of healthcare as he mentions. The Obama reform plan does have cost reduction aspects in it, but the GOP is doing what it can to neuter the plan. Mankiw only mentions the rising costs of new technology as the driver of healthcare costs. This is a factor but it is only one of many. Every industrial economy is using new technology as it becomes available, but most are able to provide universal coverage and excellent healthcare at half the per capita cost than the US. They have more efficient systems of delivering healthcare and containing provider price inflation.

Lastly, the US is not like Greece in many respects. It is not likely to encounter problems in the future that are anything like Greece faces. Presumably, Mankiw wrote this article to encourage us to thinks about changes that we need to make today in order to provide a better future for future generations. The message that he delivered appears to be more consistent with conservative efforts to frighten Americans about the future as a result of overspending by government.

US Budget Battle and its Consequences

link here to article

The GOP had started out the battle with Paul Ryan's plan to cut $32 billion in discretionary spending from the 2011 budget. It escalated to a $74 billion cut proposed by the GOP leadership. The Tea Party crowd objected to the House leadership plan and demanded a $100 billion cut. The administration started out with a $20 billion cut and it looks as if it has moved to $50 billion compromise to prevent the GOP shutdown of government by failing to raise the national debt level.

If the next compromise is to split the difference between the Tea Party goal of $100 billion and the new administration target of $50 billion, the result would be close to the House leadership proposal of $75 billion. So it looks as if the GOP, by taking a harder stance on budget cuts, that are believable because of Tea Party demands, will win the negotiation battle at the expense of the American people. Unemployment will rise; economic growth will slow and vital government services will disappear. This will set the stage for the 2012 election cycle with the economy in very bad shape. This will be good for the GOP but bad for the country.

What is described above is just another political contest over budget negotiations. The outcome will not be good but the real shame is that it does little to deal with our long-term deficit problems. They are all about the rising share of healthcare costs in the projected budgets. The GOP has turned the battle of budget deficits to a way to appease its Tea Party supporters who have no understanding about the central issues. Unfortunately, the administration believes that has been forced into the wrong game and it has chosen to be weak player in the game.

The GOP had started out the battle with Paul Ryan's plan to cut $32 billion in discretionary spending from the 2011 budget. It escalated to a $74 billion cut proposed by the GOP leadership. The Tea Party crowd objected to the House leadership plan and demanded a $100 billion cut. The administration started out with a $20 billion cut and it looks as if it has moved to $50 billion compromise to prevent the GOP shutdown of government by failing to raise the national debt level.

If the next compromise is to split the difference between the Tea Party goal of $100 billion and the new administration target of $50 billion, the result would be close to the House leadership proposal of $75 billion. So it looks as if the GOP, by taking a harder stance on budget cuts, that are believable because of Tea Party demands, will win the negotiation battle at the expense of the American people. Unemployment will rise; economic growth will slow and vital government services will disappear. This will set the stage for the 2012 election cycle with the economy in very bad shape. This will be good for the GOP but bad for the country.

What is described above is just another political contest over budget negotiations. The outcome will not be good but the real shame is that it does little to deal with our long-term deficit problems. They are all about the rising share of healthcare costs in the projected budgets. The GOP has turned the battle of budget deficits to a way to appease its Tea Party supporters who have no understanding about the central issues. Unfortunately, the administration believes that has been forced into the wrong game and it has chosen to be weak player in the game.

Wall Street Profits Surge in 2010

link here to article

The latest GDP figures for 2010 include data on corporate profits. Corporate profits were at a record high in 2010 but all of the gain came from a big increase in financial sector profit which account for 30% of all corporate profits. The financial sector earned this share of corporate profits by providing only 10% of corporate added value. In two years financial sector profits have gone from a $65 billion loss in 2008 to $426.5 billion in 2010. Part of the gain is attributed to the low cost of funds that are obtained from the Fed at almost zero interest.

The banks are worried that financial reform will shift some of its profits to other sectors. For example, if the banks get lower fees for debit card transactions this will shift some of their profits to the merchandize sector.

The latest GDP figures for 2010 include data on corporate profits. Corporate profits were at a record high in 2010 but all of the gain came from a big increase in financial sector profit which account for 30% of all corporate profits. The financial sector earned this share of corporate profits by providing only 10% of corporate added value. In two years financial sector profits have gone from a $65 billion loss in 2008 to $426.5 billion in 2010. Part of the gain is attributed to the low cost of funds that are obtained from the Fed at almost zero interest.

The banks are worried that financial reform will shift some of its profits to other sectors. For example, if the banks get lower fees for debit card transactions this will shift some of their profits to the merchandize sector.

Monday, March 28, 2011

The Attack on Financial Reform

link here to article

The Dodd, Frank reform bill leaves a lot of discretion with regulatory agencies to interpret the intent of the law and to enforce it. The lobbying by the banking industry has been intense against aspects of the bill which limit their risky rent seeking behavior. The GOP has been most eager to show its support for neutering the law. Its approach is similar to its response to the healthcare reform bill. They are cutting the budgets for the agencies that are responsible for enforcing the bill. They can cover their actions by their generic opposition to big government and government spending. They are also trying to staff the agency leaders so that it will be more difficult to make decisions and get things done.

The Obama administration has an opportunity to provide some leadership by choosing the most qualified person for heading up the Consumer Protection Agency. The GOP will oppose a competent leader like Elizabeth Warren but this is a good way to expose its game plan to the public. She handles herself well when faced with tough questions. It would also excite his base which has been looking for signs of leadership. The risk, of course, is that it will be more difficult for him to raise campaign funds from Wall Street.

The Dodd, Frank reform bill leaves a lot of discretion with regulatory agencies to interpret the intent of the law and to enforce it. The lobbying by the banking industry has been intense against aspects of the bill which limit their risky rent seeking behavior. The GOP has been most eager to show its support for neutering the law. Its approach is similar to its response to the healthcare reform bill. They are cutting the budgets for the agencies that are responsible for enforcing the bill. They can cover their actions by their generic opposition to big government and government spending. They are also trying to staff the agency leaders so that it will be more difficult to make decisions and get things done.

The Obama administration has an opportunity to provide some leadership by choosing the most qualified person for heading up the Consumer Protection Agency. The GOP will oppose a competent leader like Elizabeth Warren but this is a good way to expose its game plan to the public. She handles herself well when faced with tough questions. It would also excite his base which has been looking for signs of leadership. The risk, of course, is that it will be more difficult for him to raise campaign funds from Wall Street.

Do Lower Wages in the US Increase Employment?

link here to article

Some GOP politicians are arguing that cutting the number of government workers will help to create jobs in private industry. They claim that this will create more competition for jobs and lower wages. When wages fall, employers will have an incentive to hire more workers.

Krugman explains why that does not work in the US which has its own floating currency and when short term interest rates are already zero. Lower prices increase aggregate demand as follow: There is a lower demand for dollars which leads to lower interest rates which should increase spending. Since interest rates can't go lower than zero, there will be no increase in spending in the US by lowering wages. We get deflation which increases everyone's debt burden because debt must be repaid with more valuable dollars. (Dollars are worth more when they can purchase more at the same price)

In countries that share a common currency like Ireland, lower wages may lead to more employment. For example, Irish workers will be less expansive that German workers who share their currency.

Some GOP politicians are arguing that cutting the number of government workers will help to create jobs in private industry. They claim that this will create more competition for jobs and lower wages. When wages fall, employers will have an incentive to hire more workers.

Krugman explains why that does not work in the US which has its own floating currency and when short term interest rates are already zero. Lower prices increase aggregate demand as follow: There is a lower demand for dollars which leads to lower interest rates which should increase spending. Since interest rates can't go lower than zero, there will be no increase in spending in the US by lowering wages. We get deflation which increases everyone's debt burden because debt must be repaid with more valuable dollars. (Dollars are worth more when they can purchase more at the same price)

In countries that share a common currency like Ireland, lower wages may lead to more employment. For example, Irish workers will be less expansive that German workers who share their currency.

High Finance is Similar to Warfare

link here to article

This article requires a thoughtful read but it makes several very important points that explain our recent financial crisis and predicts the next one that is sure to follow in the US, since our government has decided not to limit the destructive behavior that is implicit in the system.

One of the important insights in this article is that complexity is central to financial firm rent seeking behavior. Profits are limited in an efficient market because both parties to a transaction have equal knowledge. Therefore, banks create financial products that are opaque and complex. For a simple example, read your credit card agreement. It is incomprehensible to most people and lots of money was spent on legal efforts to make it that way. The banks have protected themselves with the agreements and the consumer is taking unknown risks. This is common to even more complex instruments such as CDO's and other derivatives that bankers sell to supposedly sophisticated customers.

The problems with complexity, which Finance creates in order to harvest risk as excess profit, is that it creates unknown unknowns. That is, complexity does not simply amplify risk, it creates unanticipated risks. It is even more of a problem when the players in the system are tightly coupled as we observed in the last crisis. Problems at Lehman, for example, created problems with all of its counterparty's which led to unanticipated problems elsewhere. It also means that a process moves forward faster than we can analyze and react to it. Decisions had to be made quickly and not all of them were good decisions.

Warfare is a complex system that has destruction as its endpoint. Once the war begins both sides have set in motion a game that can only end by the capitulation of one of the parties that must accept defeat. The US, for example, is unable to extract itself from a war against terror which is not a state that can be destroyed. It cannot stop the war without admitting defeat and suffering the political consequences. Our financial system is similar to warfare in the sense that it is predicated on complexity and tight coupling which leads to unanticipated risks that make destruction likely. It is only able to continue in its rent seeking forms of complexity because the state is there to rescue it.

This article requires a thoughtful read but it makes several very important points that explain our recent financial crisis and predicts the next one that is sure to follow in the US, since our government has decided not to limit the destructive behavior that is implicit in the system.

One of the important insights in this article is that complexity is central to financial firm rent seeking behavior. Profits are limited in an efficient market because both parties to a transaction have equal knowledge. Therefore, banks create financial products that are opaque and complex. For a simple example, read your credit card agreement. It is incomprehensible to most people and lots of money was spent on legal efforts to make it that way. The banks have protected themselves with the agreements and the consumer is taking unknown risks. This is common to even more complex instruments such as CDO's and other derivatives that bankers sell to supposedly sophisticated customers.

The problems with complexity, which Finance creates in order to harvest risk as excess profit, is that it creates unknown unknowns. That is, complexity does not simply amplify risk, it creates unanticipated risks. It is even more of a problem when the players in the system are tightly coupled as we observed in the last crisis. Problems at Lehman, for example, created problems with all of its counterparty's which led to unanticipated problems elsewhere. It also means that a process moves forward faster than we can analyze and react to it. Decisions had to be made quickly and not all of them were good decisions.

Warfare is a complex system that has destruction as its endpoint. Once the war begins both sides have set in motion a game that can only end by the capitulation of one of the parties that must accept defeat. The US, for example, is unable to extract itself from a war against terror which is not a state that can be destroyed. It cannot stop the war without admitting defeat and suffering the political consequences. Our financial system is similar to warfare in the sense that it is predicated on complexity and tight coupling which leads to unanticipated risks that make destruction likely. It is only able to continue in its rent seeking forms of complexity because the state is there to rescue it.

Wisconsin GOP Effort to Discredit Scholar Backfires

link here to article

The GOP may have picked the wrong professor to smear. William Cronon is the incoming President of the American Historical Association. The AHA just released this response to the GOP request to the University for access to Cronon's university email account after he published an op-ed critical of the GOP's anti-union actions after taking power in Wisconsin.

The tactic used by the GOP in Wisconsin is standard operating procedure for conservative action groups. Last year, they hacked into university email accounts to fish for anything that might discredit climate scientists. Some of the researchers made snide remarks about climate change deniers. Those comments were spread all over the world and it was enough the change public opinion about the validity of climate scientist's evidence on the environmental threats associated with global warming.

I have lots of friends who have been republican's most of their lives. It used to be a party that had some principles and most of its elected officials put the country ahead of party politics. This is no longer true. The party has been taken over by far right organizations that puts its agenda ahead of that of the country. Their effort to silence academic critics is not part of the America in which most of us believe. It is more typical of autocratic regimes that most American's detest.

The GOP may have picked the wrong professor to smear. William Cronon is the incoming President of the American Historical Association. The AHA just released this response to the GOP request to the University for access to Cronon's university email account after he published an op-ed critical of the GOP's anti-union actions after taking power in Wisconsin.

The tactic used by the GOP in Wisconsin is standard operating procedure for conservative action groups. Last year, they hacked into university email accounts to fish for anything that might discredit climate scientists. Some of the researchers made snide remarks about climate change deniers. Those comments were spread all over the world and it was enough the change public opinion about the validity of climate scientist's evidence on the environmental threats associated with global warming.

I have lots of friends who have been republican's most of their lives. It used to be a party that had some principles and most of its elected officials put the country ahead of party politics. This is no longer true. The party has been taken over by far right organizations that puts its agenda ahead of that of the country. Their effort to silence academic critics is not part of the America in which most of us believe. It is more typical of autocratic regimes that most American's detest.

Key German Election Votes Against Nuclear Energy Policy

link here to article

Angela Merkel's conservative party lost an election in a German state that has been a stronghold of the party for over 30 years. The result reflects the growing strength of the Green Party which has opposed Merkel's pro nuclear energy policy. This result obviously reflects concerns over the use of nuclear energy given the recent crisis in Japan.

Angela Merkel's conservative party lost an election in a German state that has been a stronghold of the party for over 30 years. The result reflects the growing strength of the Green Party which has opposed Merkel's pro nuclear energy policy. This result obviously reflects concerns over the use of nuclear energy given the recent crisis in Japan.

Sunday, March 27, 2011

Is $54 million Pay for Ford CEO Too Much?

link here to article

Mark Thoma does a good job of trying to answer this question. Economic theory says that pay is a function of productivity. In that case, the Ford CEO would have earned the $54 million by his contribution to the productivity of Ford employees. Obviously, one cannot measure CEO productivity so we can't use economic theory to answer the question. We can, however, compare CEO's in the US with CEO's in other countries. American CEO's are paid several times what CEO's in Europe and Japan earn. It would be hard to argue that they are several times as productive as their CEO counterparts overseas. Some research suggests that there is a relationship between CEO pay and poor performance. Overpaid CEO's, in that case, reflects weak corporate governance which contributes to poor performance. Mark Thoma also suggests that linking CEO pay to financial results may influence CEO's to make decisions that maximize short term performance at the expense of longer term growth and profitability.

The best study that I have read on this subject is in a book called " Searching for a Corporate Savior". It was written by R. Khurana, a Harvard professor who did a study of the CEO selection process by corporate boards. He concluded that there is no market for corporate CEO's, in the sense that economists refer to markets, where the price is determined by supply and demand factors. CEO pay is determined by a process that is primarily devoted to justifying whatever the CEO and the board agree upon. It is an irrational process that is made to look rational.

Mark Thoma does a good job of trying to answer this question. Economic theory says that pay is a function of productivity. In that case, the Ford CEO would have earned the $54 million by his contribution to the productivity of Ford employees. Obviously, one cannot measure CEO productivity so we can't use economic theory to answer the question. We can, however, compare CEO's in the US with CEO's in other countries. American CEO's are paid several times what CEO's in Europe and Japan earn. It would be hard to argue that they are several times as productive as their CEO counterparts overseas. Some research suggests that there is a relationship between CEO pay and poor performance. Overpaid CEO's, in that case, reflects weak corporate governance which contributes to poor performance. Mark Thoma also suggests that linking CEO pay to financial results may influence CEO's to make decisions that maximize short term performance at the expense of longer term growth and profitability.

The best study that I have read on this subject is in a book called " Searching for a Corporate Savior". It was written by R. Khurana, a Harvard professor who did a study of the CEO selection process by corporate boards. He concluded that there is no market for corporate CEO's, in the sense that economists refer to markets, where the price is determined by supply and demand factors. CEO pay is determined by a process that is primarily devoted to justifying whatever the CEO and the board agree upon. It is an irrational process that is made to look rational.

Saturday, March 26, 2011

Freedom of Speech in a GOP Led Wisconsin

A professor at the University of Wisconsin wrote an op-ed in the NYT critical of the GOP's misuse of power. The GOP response was to demand access to his university email records. What they hope to find is anything that can be used to discredit him as a critic. This would also have a chilling effect in academia. Anyone critical of government might fear that the government would poke into their private email records. Is this the kind of America that the GOP represents?

One More Time Its Healthcare Price Inflation Stupid

This graph puts the long term US deficit in the proper focus. The current plan is to keep tax revenue as a percent of GDP flat and to make cuts in discretionary spending. The only spending that really matters is healthcare spending. The GOP is trying to repeal the only plan that we have to limit growth in healthcare spending and its base is convinced that cutting the parts of the budget that don't matter is whats important. Getting rid of earmarks in response to their base has little impact on the budget but it has a big political impact. It excites the neanderthals.

Friday, March 25, 2011

Keynes Describes His Conflict With Orthodox Economics

link here to article

This is a transcript of a BBC speech by Keynes 2 years before he published his landmark book which detailed some of his thinking in this speech. He refers to orthodox economists as those who hold the view that markets are self correcting and that are better off to let them self correct when there is an economic downturn than we would be if the state intervened in the market. He expresses respect for the orthodoxy that he was taught and he acknowledges the hold that it has on the thinking of economists and practitioners alike. He points out, however, that Marx's attack on capitalism is based upon his understanding of Ricardian theory which dominated the profession. There is a sense that defending the orthodox view is a justification for Marxism which had made a strong attack on the logic of capitalism and the consequences of extending that logic to the future. He was beginning to realize that the doctrine of laissez-faire and Marxism were intertwined and that both failed to explain economic reality.

Keynes's language is arcane and hard to follow for a modern reader but this short article explains much of the debate that we are seeing today as economists and politicians consider how to deal with the economic downturn. Orthodox economists have resorted to the use of Ricardian theory that Keynes was attacking to argue that fiscal policy would not work to end the recession. Keynes also attacks the dependence of orthodox theory on the concept of self adjusting interest rates. The idea is that interest rates will fall in a recession and encourage business to spend on new investment and it will also encourage consumers to spend with the use of cheap credit. Keynes did not believe that business would invest, even with low interest rates, if they were not confident in achieving an adequate return on its investment. He was also aware of the liquidity trap that we have today when interest rates are at the zero bound and business investment is still stagnant.

Kenes considers some of the things that might be done to get out of the depression. One of the things that he considered was the redistribution of income from those who tend to save a large portion of their income to those who would spend most of it and also receive a higher benefit from the spending due to decreasing marginal utility of consumption as income increases. He also talked about ways to encourage business investment and compared the two approaches. His hope was that ultimately there would be sufficient capital investment to produce all of the real necessities of life for everyone and the result could be greater leisure and the enjoyment of the better things in life did not require undue consumption.

This is a transcript of a BBC speech by Keynes 2 years before he published his landmark book which detailed some of his thinking in this speech. He refers to orthodox economists as those who hold the view that markets are self correcting and that are better off to let them self correct when there is an economic downturn than we would be if the state intervened in the market. He expresses respect for the orthodoxy that he was taught and he acknowledges the hold that it has on the thinking of economists and practitioners alike. He points out, however, that Marx's attack on capitalism is based upon his understanding of Ricardian theory which dominated the profession. There is a sense that defending the orthodox view is a justification for Marxism which had made a strong attack on the logic of capitalism and the consequences of extending that logic to the future. He was beginning to realize that the doctrine of laissez-faire and Marxism were intertwined and that both failed to explain economic reality.

Keynes's language is arcane and hard to follow for a modern reader but this short article explains much of the debate that we are seeing today as economists and politicians consider how to deal with the economic downturn. Orthodox economists have resorted to the use of Ricardian theory that Keynes was attacking to argue that fiscal policy would not work to end the recession. Keynes also attacks the dependence of orthodox theory on the concept of self adjusting interest rates. The idea is that interest rates will fall in a recession and encourage business to spend on new investment and it will also encourage consumers to spend with the use of cheap credit. Keynes did not believe that business would invest, even with low interest rates, if they were not confident in achieving an adequate return on its investment. He was also aware of the liquidity trap that we have today when interest rates are at the zero bound and business investment is still stagnant.

Kenes considers some of the things that might be done to get out of the depression. One of the things that he considered was the redistribution of income from those who tend to save a large portion of their income to those who would spend most of it and also receive a higher benefit from the spending due to decreasing marginal utility of consumption as income increases. He also talked about ways to encourage business investment and compared the two approaches. His hope was that ultimately there would be sufficient capital investment to produce all of the real necessities of life for everyone and the result could be greater leisure and the enjoyment of the better things in life did not require undue consumption.

GE Puts Imagination to Work in its Tax Department

link here to article

I tell my students that there are two things that government does: They collect revenues from taxes and they spend the revenues. The best way to understand government is to figure out who they decide to take the money from and what they spend it on. This article on GE tells us some important things about where the tax money comes from. GE's tax department is regarded as one of the best in the business. This article describes how GE was able to get a $4 billion tax refund on top of its operating profits last year. One of GE's tactics is to arrange things so that its profits are concentrated in low tax off shore countries like Ireland and Singapore. Most multinational corporations operate in a similar way. The result is that the share of US taxes paid by US corporations has fallen from 30% in the mid 1950's to only 6.6% in 2009. At the same time corporate lobbyists are complaining that the corporate tax rate needs to be reduced in order to make corporations more competitive with overseas companies that have lower corporate tax rates. They argue that this will help to create jobs and many of our politicians agree with that argument. GE, which receives a tax rebate instead of paying taxes has reduced US employment by 20% in the meantime.

Some people will applaud GE and its tax department for being so good at what it does that it is regarded within GE as a profit center. They should consider the consequence, however, when multinational corporates like GE pay lower taxes or no taxes, the rest of us pay higher taxes or the government runs budget deficits. This shifts the tax burden to domestic corporations that do not have off shore tax havens, and to individuals who do not pay millions in lobbying to shift the tax burden to others.

I tell my students that there are two things that government does: They collect revenues from taxes and they spend the revenues. The best way to understand government is to figure out who they decide to take the money from and what they spend it on. This article on GE tells us some important things about where the tax money comes from. GE's tax department is regarded as one of the best in the business. This article describes how GE was able to get a $4 billion tax refund on top of its operating profits last year. One of GE's tactics is to arrange things so that its profits are concentrated in low tax off shore countries like Ireland and Singapore. Most multinational corporations operate in a similar way. The result is that the share of US taxes paid by US corporations has fallen from 30% in the mid 1950's to only 6.6% in 2009. At the same time corporate lobbyists are complaining that the corporate tax rate needs to be reduced in order to make corporations more competitive with overseas companies that have lower corporate tax rates. They argue that this will help to create jobs and many of our politicians agree with that argument. GE, which receives a tax rebate instead of paying taxes has reduced US employment by 20% in the meantime.

Some people will applaud GE and its tax department for being so good at what it does that it is regarded within GE as a profit center. They should consider the consequence, however, when multinational corporates like GE pay lower taxes or no taxes, the rest of us pay higher taxes or the government runs budget deficits. This shifts the tax burden to domestic corporations that do not have off shore tax havens, and to individuals who do not pay millions in lobbying to shift the tax burden to others.

Austerity Now Strategy Failing in Europe

link here to article

The yield on Irish debt is now 10% and unemployment is 13%. Portugal's debt has become more expensive and the economy is not recovering. Britain has lowered its growth forecast and unemployment has not recovered. Deficit hawks cheered their austerity plans but their economies are lagging behind. That means that tax revenues will continue to fall and erode any impact from spending cuts. Krugman argues that we should be putting people back to work now in order to increase tax revenue and put a plan in place to deal with the real fiscal problems we have in the long run. It seems as if politicians are more focused on what they do best: political campaigning, instead of solving our real problems.

The yield on Irish debt is now 10% and unemployment is 13%. Portugal's debt has become more expensive and the economy is not recovering. Britain has lowered its growth forecast and unemployment has not recovered. Deficit hawks cheered their austerity plans but their economies are lagging behind. That means that tax revenues will continue to fall and erode any impact from spending cuts. Krugman argues that we should be putting people back to work now in order to increase tax revenue and put a plan in place to deal with the real fiscal problems we have in the long run. It seems as if politicians are more focused on what they do best: political campaigning, instead of solving our real problems.

Thursday, March 24, 2011

China Did a Better Job of Dealing with Recession Than the West

link here to article

This article describes a balance sheet recession and why it requires a substantial fiscal response. That is what China did and they are out of recession. It is also what eventually got Japan out of recession after a long period of an inadequate fiscal response. Much of the western countries look like Japan in the early stages of its balance sheet recession.

This article describes a balance sheet recession and why it requires a substantial fiscal response. That is what China did and they are out of recession. It is also what eventually got Japan out of recession after a long period of an inadequate fiscal response. Much of the western countries look like Japan in the early stages of its balance sheet recession.

Wall Street Versus the Rest of Us

link here to article

This article describes one of the many battles underway in Washington in which banks are attempting to limits aspects of the financial reform bill that will cut into their profits. The focus of this article is on the fees that the duopoly of Master Card and Visa charge merchants for every debit card transaction. These fees add up to $16 billion, and merchants pass much of this cost back to consumers via higher prices. Since there is no competition in this market the fees are higher than they would otherwise be. This is just another form of rent extraction that is quite common on Wall Street, where there is little price competition for many of the fees that the banks receive for services provided. The proposed reform would set the fees to the level that has been set in Europe so the banks can't argue that it would not be profitable, it would just reduce their rent extraction. The argument made by the banks is that it is not a battle between consumers and the banks but between merchants and banks. This argument presumes that merchants do not pass much of the cost to the consumer.

The other point made in this article is more bothersome. Just prior to the last recession, 40% of all corporate profits in the US went to financial service providers. Profits fell, of course in the recession, but they are now approaching their prior peak. We have an economy in which a major share of corporate profits go to financial service providers. It is also an industry that is not subject to price competition for many of the services provided. That is one of the reasons why wages are much higher on Wall Street than elsewhere in the economy. It is also one of the reasons why middle class wages have not grown much over the last 30 years. Historically, is has not been good for an economy to have the financial sector represent such a high percentage of the economy.

This article describes one of the many battles underway in Washington in which banks are attempting to limits aspects of the financial reform bill that will cut into their profits. The focus of this article is on the fees that the duopoly of Master Card and Visa charge merchants for every debit card transaction. These fees add up to $16 billion, and merchants pass much of this cost back to consumers via higher prices. Since there is no competition in this market the fees are higher than they would otherwise be. This is just another form of rent extraction that is quite common on Wall Street, where there is little price competition for many of the fees that the banks receive for services provided. The proposed reform would set the fees to the level that has been set in Europe so the banks can't argue that it would not be profitable, it would just reduce their rent extraction. The argument made by the banks is that it is not a battle between consumers and the banks but between merchants and banks. This argument presumes that merchants do not pass much of the cost to the consumer.

The other point made in this article is more bothersome. Just prior to the last recession, 40% of all corporate profits in the US went to financial service providers. Profits fell, of course in the recession, but they are now approaching their prior peak. We have an economy in which a major share of corporate profits go to financial service providers. It is also an industry that is not subject to price competition for many of the services provided. That is one of the reasons why wages are much higher on Wall Street than elsewhere in the economy. It is also one of the reasons why middle class wages have not grown much over the last 30 years. Historically, is has not been good for an economy to have the financial sector represent such a high percentage of the economy.

Is Owning a Home a Good Investment?

link here to article

The graph in the this article shows nominal appreciation in housing prices and price appreciation corrected for inflation (real price). A lot of people have sold a home at a profit or they have heard of people holding a home for a long time selling it for twice what they paid for it. The nominal price appreciation line shows that effect. On the other hand, the real price appreciation line is flat except for certain periods of boom or bust. That means that purchasing a home has not been a good investment. It is, however, a forced way to save money. Part of every mortgage payment increases one's equity in the home which is an asset. If one pays cash for the home it is then simple a way to store money for future use.

The graph in the this article shows nominal appreciation in housing prices and price appreciation corrected for inflation (real price). A lot of people have sold a home at a profit or they have heard of people holding a home for a long time selling it for twice what they paid for it. The nominal price appreciation line shows that effect. On the other hand, the real price appreciation line is flat except for certain periods of boom or bust. That means that purchasing a home has not been a good investment. It is, however, a forced way to save money. Part of every mortgage payment increases one's equity in the home which is an asset. If one pays cash for the home it is then simple a way to store money for future use.

Go East Young Man Go East

link here to article

This map shows how the center of the worlds economic activity has shifted since 1980. It illustrates what most of know.

This map shows how the center of the worlds economic activity has shifted since 1980. It illustrates what most of know.

Wednesday, March 23, 2011

San Francisco Fed Study of Recent College Grad Unemployment

link here to article

The last two US recessions have seen recovery's with weak growth in employment. Some have explained this as a mismatch between the skills being sought by employers and the skills of the labor force. In that case we have a structural unemployment problem and not a lack of demand for labor. This study by the San Francisco Fed did what those who assert that we have a structural unemployment problem did not do. They looked at some data. The looked at unemployment data for recent college grads in both the 2001 recession and the 2008 recession. Recent college grads are usually prized because they are easily trained for specific jobs and they are flexible in terms of location. The Fed found that the unemployment rate for recent grads was similar to that of the general labor force and they concluded that the jobless recovery's in the last two recessions are due to the lack of demand for labor. Therefore, we have an unemployment problem that is related to a weak business cycle and which can be mitigated by stimulating the economy.

The last two US recessions have seen recovery's with weak growth in employment. Some have explained this as a mismatch between the skills being sought by employers and the skills of the labor force. In that case we have a structural unemployment problem and not a lack of demand for labor. This study by the San Francisco Fed did what those who assert that we have a structural unemployment problem did not do. They looked at some data. The looked at unemployment data for recent college grads in both the 2001 recession and the 2008 recession. Recent college grads are usually prized because they are easily trained for specific jobs and they are flexible in terms of location. The Fed found that the unemployment rate for recent grads was similar to that of the general labor force and they concluded that the jobless recovery's in the last two recessions are due to the lack of demand for labor. Therefore, we have an unemployment problem that is related to a weak business cycle and which can be mitigated by stimulating the economy.

The Survival of the Least Fit in Washington

link here to article

The GOP is blocking the appointment of highly qualified people to key positions in government. We already discussed the administrations problems getting Elizabeth Warren into the Consumer Protection Agency. She is one of several other candidates with excellent qualifications who are being blocked. Krugman compares this with the way in which the Bush administration staffed the Provisional Authority that was put in charge of running Iraq. The primary qualification for an appointment was loyalty to the GOP and its value system. Many key positions were staffed with inexperienced people who messed things up badly. This was also true in the Justice Department. Important jobs were given to interns with degrees from Liberty University whose qualifications were based on loyalty to the Bush agenda instead of legal expertise. We all remember the Katrina fiasco as well and Bush's comment during the fiasco "Good job Brownie" in reference to the head of FEMA who had no previous experience in disaster relief but who was a good friend of one of Bush's old buddies. This is the way that many third world countries are run. That is the direction that we are headed as long as we keep electing people to government whose primary concern is that it not be run well.

The GOP is blocking the appointment of highly qualified people to key positions in government. We already discussed the administrations problems getting Elizabeth Warren into the Consumer Protection Agency. She is one of several other candidates with excellent qualifications who are being blocked. Krugman compares this with the way in which the Bush administration staffed the Provisional Authority that was put in charge of running Iraq. The primary qualification for an appointment was loyalty to the GOP and its value system. Many key positions were staffed with inexperienced people who messed things up badly. This was also true in the Justice Department. Important jobs were given to interns with degrees from Liberty University whose qualifications were based on loyalty to the Bush agenda instead of legal expertise. We all remember the Katrina fiasco as well and Bush's comment during the fiasco "Good job Brownie" in reference to the head of FEMA who had no previous experience in disaster relief but who was a good friend of one of Bush's old buddies. This is the way that many third world countries are run. That is the direction that we are headed as long as we keep electing people to government whose primary concern is that it not be run well.

Tuesday, March 22, 2011

Detroit as a Symbol of Post Industrial US

link here to article

In 1950 Detroit's population was close to 2 million and it was the 4th largest city in the US. The 2010 census shows that the population is now 713,000 and it is the 18th largest city in the US. Over one million residents have left the city. It is now smaller than Charlotte, NC, Austin TX, and Jacksonville, Fla. The loss of population and the tax base has turned a once great city into a ghost town.

In 1950 Detroit's population was close to 2 million and it was the 4th largest city in the US. The 2010 census shows that the population is now 713,000 and it is the 18th largest city in the US. Over one million residents have left the city. It is now smaller than Charlotte, NC, Austin TX, and Jacksonville, Fla. The loss of population and the tax base has turned a once great city into a ghost town.

Key Ruling against Deutshe Bank on Derivative Sale

link here to article

The bank argued that any high school grad could do the math necessary to understand what was being purchased. The court disagreed. This sets a precedent for banks who argue that customers know what they are purchasing when the bank is an advisor as well as a seller.

The bank argued that any high school grad could do the math necessary to understand what was being purchased. The court disagreed. This sets a precedent for banks who argue that customers know what they are purchasing when the bank is an advisor as well as a seller.

Why Was Unemployment In Germany in Recession Lower Than US?

link here to article

This study by Brookings Institute attempts to isolate the factors that contributed to Germany's better employment numbers during a recession in GDP declined more than it did in the US. We know that businesses in the US cut employment rapidly and drastically at the first signs of recession in the US. It explains the different response by business in Germany to the fact that they had not increased employment during good times prior to recession and that labor laws gave them more flexibility in assigning hours so that overtime premia were reduced.

Some economists in the US argue that safety net for workers is better than that in the US and that this kept consumer demand from falling as dramatically as it did in the US.

This study by Brookings Institute attempts to isolate the factors that contributed to Germany's better employment numbers during a recession in GDP declined more than it did in the US. We know that businesses in the US cut employment rapidly and drastically at the first signs of recession in the US. It explains the different response by business in Germany to the fact that they had not increased employment during good times prior to recession and that labor laws gave them more flexibility in assigning hours so that overtime premia were reduced.

Some economists in the US argue that safety net for workers is better than that in the US and that this kept consumer demand from falling as dramatically as it did in the US.

What Do Americans Know and Think About Rising Wealth Inequality?

link here to article

This article (via Manan Shukla) looks at what Americans know about the level of inequality and it finds that they are poorly informed about it and that their ideal distribution would be more equal. There are some discussions by a selected group of commentators with different outlooks, but the comments to this article show that opinions on this topic are all over the map. It would be more helpful to examine the sources of rising inequality and to also look at policies that may have contributed to the rise in inequality. Inequality is not the issue. The rise in inequality should be our concern.

This article (via Manan Shukla) looks at what Americans know about the level of inequality and it finds that they are poorly informed about it and that their ideal distribution would be more equal. There are some discussions by a selected group of commentators with different outlooks, but the comments to this article show that opinions on this topic are all over the map. It would be more helpful to examine the sources of rising inequality and to also look at policies that may have contributed to the rise in inequality. Inequality is not the issue. The rise in inequality should be our concern.

Economists Need to Understand the True Cost of Goods

link here to article

This short article (via Manan Shukla) tells a simple but profound story told by an economist living in Chile. He lives in an area that has some of the best dairy products in the world and he was surprised to find that the butter he was offered in a restaurant came from overseas. The butter from overseas had a lower price than local butter because of government subsidies which overcame the cost of transport. The cost of transport to the environment, however, is not part of the cost structure that economists would consider relevant. Environmental damage is not internalized so it does not exist.

This short article (via Manan Shukla) tells a simple but profound story told by an economist living in Chile. He lives in an area that has some of the best dairy products in the world and he was surprised to find that the butter he was offered in a restaurant came from overseas. The butter from overseas had a lower price than local butter because of government subsidies which overcame the cost of transport. The cost of transport to the environment, however, is not part of the cost structure that economists would consider relevant. Environmental damage is not internalized so it does not exist.

UK Jobless Recovery and Budget Policy in Conflict

link here to article

The conservative UK government continues to push for cuts in government spending in the face of a weak recovery. The Financial Times has argued that government policy will only make the economy worse. The government, however, believes that fiscal austerity will improve business confidence and help to stimulate the economy. Their belief in the "confidence fairy" is very similar to that of conservatives in the US.

This article does not mention the recent inflation numbers in the UK. Despite the weak economy, and falling wage income, inflation is over 4% in the UK. Well below the 2% target rate. It is driven by rising commodity prices and increases in the prices of some common household items. This may make it difficult for the Bank of England to keep interest rates at their current level. If the central bank if forced to raise interest rates, the economy will be hit with a double whammy. Fiscal austerity and higher interest rates will slow growth even further.

The conservative UK government continues to push for cuts in government spending in the face of a weak recovery. The Financial Times has argued that government policy will only make the economy worse. The government, however, believes that fiscal austerity will improve business confidence and help to stimulate the economy. Their belief in the "confidence fairy" is very similar to that of conservatives in the US.

This article does not mention the recent inflation numbers in the UK. Despite the weak economy, and falling wage income, inflation is over 4% in the UK. Well below the 2% target rate. It is driven by rising commodity prices and increases in the prices of some common household items. This may make it difficult for the Bank of England to keep interest rates at their current level. If the central bank if forced to raise interest rates, the economy will be hit with a double whammy. Fiscal austerity and higher interest rates will slow growth even further.

Existing Home Sales Down and Prices Fall to 2002 Level

link here to article

The latest report on existing home sales show the housing market will continue to be a drag on the US economy. Sales were well below forecast and prices are at a 9 year low. Short sales and sale of foreclosed homes were 39% of existing home sales and this may account for the fall in prices. Prices for existing homes are well below the cost of new construction. Inventories are 30% higher than they were before the recession and they are also a drag on the market. The inventory numbers may even understate the real level since banks have not put all of their non performing inventory on the market.

Rising employment may help the market over time but the weak housing market prevents the economy from growing fast enough to bring unemployment levels down at a faster rate.

The latest report on existing home sales show the housing market will continue to be a drag on the US economy. Sales were well below forecast and prices are at a 9 year low. Short sales and sale of foreclosed homes were 39% of existing home sales and this may account for the fall in prices. Prices for existing homes are well below the cost of new construction. Inventories are 30% higher than they were before the recession and they are also a drag on the market. The inventory numbers may even understate the real level since banks have not put all of their non performing inventory on the market.

Rising employment may help the market over time but the weak housing market prevents the economy from growing fast enough to bring unemployment levels down at a faster rate.

AT&T's Legal Challenges in T-Mobile Acquisition

link here to article

AT&T will have to pay Deutsche Telekom $3 billion penalty if its acquisition is not approved by the US government. Its acquisition of T-Mobile will result in a duopoly in the US mobile telecom market. AT&T and Verizon will dominate the industry and this raises anti-trust concerns. How will this affect consumer prices and the degree of innovation in the market?

AT&T must feel confident that it can overcome those objections. It will follow the traditional method for overcoming anti-trust objections. They will redefine the market as a system of local markets in which there are more than two competitors in each local market. That is, the national market share of the duopoly is not the relevant way to look at the market. They will also argue that only large providers can provide the level of customer service and access the broadband spectrum that is necessary to meet the national goal of wireless internet service everywhere. They must also be prepared to make some concessions in order to appease regulators. They may have to allow virtual mobile operators access to their network to provide services as well.

AT&T will have to pay Deutsche Telekom $3 billion penalty if its acquisition is not approved by the US government. Its acquisition of T-Mobile will result in a duopoly in the US mobile telecom market. AT&T and Verizon will dominate the industry and this raises anti-trust concerns. How will this affect consumer prices and the degree of innovation in the market?

AT&T must feel confident that it can overcome those objections. It will follow the traditional method for overcoming anti-trust objections. They will redefine the market as a system of local markets in which there are more than two competitors in each local market. That is, the national market share of the duopoly is not the relevant way to look at the market. They will also argue that only large providers can provide the level of customer service and access the broadband spectrum that is necessary to meet the national goal of wireless internet service everywhere. They must also be prepared to make some concessions in order to appease regulators. They may have to allow virtual mobile operators access to their network to provide services as well.

UK Banks Borrow Heavily from US Conservative Response to Bank Crisis

link here to article

Demos, a formerly left leaning, organization has written a pamphlet critical of the work done by the Independent Banking Commission (IBC) in the UK. The IBC Preliminary Report will be released in April and the final report is expected in September.

The Demos response was authored by a former MP Kitty Ussher and this article shows that her response makes many of the recommendations found in the Financial Crisis Primer which was published by conservatives who dissented from the majority report of the US commission which has already filed its report

This article begins its criticism of the Demos pamphlet by describing how the Demos Board was taken over by conservatives in 2009 following a funding crisis in 2008. The Board includes George Osborne who is Chancellor of the Exchequer in the conservative UK government.

The IBC preliminary report is extremely critical of the UK banking industry and it recommends some very serious reforms that are much stronger than those recommended by the US commission. They include breaking up the large banks that do investment banking and retail banking along with higher taxes on banker compensation.

The Demos pamphlet attempts to show that the combination of investment banking with retail banking was not a cause of the banking crisis and that the imposition of higher taxes would cause banks to move to countries with lower tax rates. It also criticizes the suggestion that the share of UK GDP, due to the banking industry, should be reduced in order to lower its dependence on the banking industry.

The IBC report goes much further than the US commission in its reform recommendations. Large banks in the UK, particularly Barclays, do not like it and large US banks will not like the implications as well.

Demos, a formerly left leaning, organization has written a pamphlet critical of the work done by the Independent Banking Commission (IBC) in the UK. The IBC Preliminary Report will be released in April and the final report is expected in September.

The Demos response was authored by a former MP Kitty Ussher and this article shows that her response makes many of the recommendations found in the Financial Crisis Primer which was published by conservatives who dissented from the majority report of the US commission which has already filed its report

This article begins its criticism of the Demos pamphlet by describing how the Demos Board was taken over by conservatives in 2009 following a funding crisis in 2008. The Board includes George Osborne who is Chancellor of the Exchequer in the conservative UK government.

The IBC preliminary report is extremely critical of the UK banking industry and it recommends some very serious reforms that are much stronger than those recommended by the US commission. They include breaking up the large banks that do investment banking and retail banking along with higher taxes on banker compensation.

The Demos pamphlet attempts to show that the combination of investment banking with retail banking was not a cause of the banking crisis and that the imposition of higher taxes would cause banks to move to countries with lower tax rates. It also criticizes the suggestion that the share of UK GDP, due to the banking industry, should be reduced in order to lower its dependence on the banking industry.

The IBC report goes much further than the US commission in its reform recommendations. Large banks in the UK, particularly Barclays, do not like it and large US banks will not like the implications as well.

Monday, March 21, 2011

How the iPhone Forced the Sale of T-Mobile USA

link here to article

Popular demand for the iPhone on which AT&T had marketing rights, which have now been extended to Verizon was damaging to T-Mobile revenue. The lost 390,000 monthly contract customers since the introduction of the iPhone. This came at a time in which they would have had to make large investments in LTE technology and in the purchase of additional network spectrum.

The deal gives Deutsche Telekom 8% ownership of AT&T and around $20 billion in cash. This gives them benefits from the US market through AT&T ownership and it allows them to use the cash to modernize its European network.

Popular demand for the iPhone on which AT&T had marketing rights, which have now been extended to Verizon was damaging to T-Mobile revenue. The lost 390,000 monthly contract customers since the introduction of the iPhone. This came at a time in which they would have had to make large investments in LTE technology and in the purchase of additional network spectrum.

The deal gives Deutsche Telekom 8% ownership of AT&T and around $20 billion in cash. This gives them benefits from the US market through AT&T ownership and it allows them to use the cash to modernize its European network.

GOP Attack on Warren Is On Schedule

link here to article