Thursday, January 30, 2014

Snowden Documents Show That NSA Spied On Allies Prior to Copenhagen Climate Change Meetings

New document released by Snowden shows that NSA intelligence gathering goes well beyond protecting the US from terrorist attacks. NSA had provided US negotiators with information about tactics and positions that other nations might take at the meeting. The negotiations failed to result in any formal agreements that would limit carbon emissions. The release of the Snowden documents will also make it more difficult for nations to trust each other in future negotiations.

What Americans Need To Know About Ukraine And The Riots In Ukraine

Ukraine is about the size of Texas (which is very big) and has almost twice the population of Texas. It is also very important to Russia for a variety of reasons. This article provides an excellent history and geography lesson which can help Americans to better understand the protests in Ukraine in the context that is required. There is not much that the US can do about the problems in Ukraine but we all need to be better educated about this very important part of the world.

Can Economsts Explain Growing Income Inequality?

A recent article by Justin Fox (which I posted previously) argued that economists are not likely to make a good case against the growth in executive pay. He pointed to an article by a prominent Harvard economist (Mankiw), who argued that increases in executive pay were determined by market forces. Standard economic theory suggests that everyone is rewarded for their marginal contribution to output. Some may believe that this is unfair or immoral but economists don't believe that they should make moral judgements (even though the prevailing theory makes growth in executive compensation appear to be based upon performance). Simon Wren-Lewis argues that economists can contribute to the debate on executive pay in this article.

Wren-Lewis argues that executive pay has been growing rapidly because of two forces. Executives have always had bargaining power because it is costly to remove a CEO, but they have a greater incentive to take advantage of their bargaining power more recently because the top marginal tax rates have been lowered. He believes that economists are in the best position to explain this to the public because they are largely unaware of the growth in income inequality, and because politicians from both major political parties realize that the public will elect the politician who they believe is most competent to run the economy. Consequently, politicians in both parties must convince the public that they will do nothing to damage business confidence. That, of course, was Romney's argument in the 2012 US election. He portrayed himself as a successful executive who was more able to run the economy. Obama won the election, but he did as much as he could to convince the public that business leaders had confidence in his ability to run the country.

Wren-Lewis is obviously correct in his argument about public opinion and the efforts by both major parties to present themselves as business friendly. However, his argument that economists are best suited to make the case for a higher marginal tax rates because they have done research on executive bargaining power, and they understand the power of tax incentives, does not pass the smell test. Economists, with few exceptions, have not made this case to the public.

One of the comments to the Wren-Lewis article makes a further point that is closely related to my following post about an economist who has made a forceful argument for higher tax rates on the wealthy. The rule of 72 provides a simple way to calculate the length of time in which it takes a quantity to double. We simply divide the rate of change into 72. For example, if the economy grows by 2%, it will take a little over 35 years for national income to double. If income for the top 1% grows by 7%, their share of national income will double in around 10 years. The share of income going to bottom 99% must continue to fall relative to that of the top 1% as long as the economy grows less rapidly than the growth rate of income for the top 1%.

The following post which makes the strongest case for a high tax on wealth was published yesterday in the NYT. It has not received the attention that it deserves. It goes much more deeply into the problem of growing inequality than most economists are willing to go.

Wren-Lewis argues that executive pay has been growing rapidly because of two forces. Executives have always had bargaining power because it is costly to remove a CEO, but they have a greater incentive to take advantage of their bargaining power more recently because the top marginal tax rates have been lowered. He believes that economists are in the best position to explain this to the public because they are largely unaware of the growth in income inequality, and because politicians from both major political parties realize that the public will elect the politician who they believe is most competent to run the economy. Consequently, politicians in both parties must convince the public that they will do nothing to damage business confidence. That, of course, was Romney's argument in the 2012 US election. He portrayed himself as a successful executive who was more able to run the economy. Obama won the election, but he did as much as he could to convince the public that business leaders had confidence in his ability to run the country.

Wren-Lewis is obviously correct in his argument about public opinion and the efforts by both major parties to present themselves as business friendly. However, his argument that economists are best suited to make the case for a higher marginal tax rates because they have done research on executive bargaining power, and they understand the power of tax incentives, does not pass the smell test. Economists, with few exceptions, have not made this case to the public.

One of the comments to the Wren-Lewis article makes a further point that is closely related to my following post about an economist who has made a forceful argument for higher tax rates on the wealthy. The rule of 72 provides a simple way to calculate the length of time in which it takes a quantity to double. We simply divide the rate of change into 72. For example, if the economy grows by 2%, it will take a little over 35 years for national income to double. If income for the top 1% grows by 7%, their share of national income will double in around 10 years. The share of income going to bottom 99% must continue to fall relative to that of the top 1% as long as the economy grows less rapidly than the growth rate of income for the top 1%.

The following post which makes the strongest case for a high tax on wealth was published yesterday in the NYT. It has not received the attention that it deserves. It goes much more deeply into the problem of growing inequality than most economists are willing to go.

Why Income Inequality Is Inevitable Under Our Current Form Of Capitalism

Thomas Piketty, a prominent professor from the Paris School of Economics, just published a book, which will be released in the US in March, that an economist from the world bank just reviewed. He cautiously concluded that Capital In The 21st Century will be one of the watershed books in economic history.

Piketty's book is extensively documented with data and analysis which leads him to conclude that worsening inequality is inevitable. His conclusion is based upon a relatively simple ratio. He argues that when the rate of return on capital exceeds the rate of economic growth, inequality will worsen. This is because capital incomes are much more concentrated than labor incomes. This is exactly what has happened since 1973. In the six decades prior to 1973 capital suffered several substantial shocks. During much of that period the economy also grew faster than the return on capital and there was much less growth in inequality. The blows to capital are well known. We had two world wars; we had the great depression; industries and property were appropriated in the post-colonial period and taxes were raised to fund the wars and to rebuild devastated industrial capital. There was also a loss of credibility and authority. For example, the New Deal in the US led to the introduction of social safety net programs, and labor organizations were strengthened.

Piketty makes a further point that will not make conservatives happy. They believe that free markets will produce economic growth and distribute the benefits from growth to everyone. They have been working hard since 1973 to reduce the role of government in the economy and to undue much of what had been done during the New Deal. Piketty reaches a different conclusion. He argues that the growth in inequality would be even greater if market forces were allowed to operate with greater freedom. In the long run pay setters set their own pay. They also are being compensated with capital rather than cash. For example, Jamie Dimon, the CEO of JP Morgan, was just awarded a $20 million package for 2013. His salary was $1.5 million and his restricted stock options amounted to $18.5 million. His board consists primarily of CEO's from other firms who had similar paydays in 2013.

Piketty reaches another conclusion that makes liberals unhappy. He argues that the only remedy for the problem of growing income inequality is a global tax on wealth. It must be global in order to prevent wealthy individuals from avoiding taxes through tax haven countries. Since there would be little support for such a tax in rich countries, or in tax haven countries, that will not happen. Therefore, inequality will continue to grow and social unrest and the weakening democratic forces is also inevitable. Liberals argue that there are alternatives to the politically impossible tax on wealth. Piketty does not believe that any of these small bore changes will have the necessary impact.

Piketty's book is extensively documented with data and analysis which leads him to conclude that worsening inequality is inevitable. His conclusion is based upon a relatively simple ratio. He argues that when the rate of return on capital exceeds the rate of economic growth, inequality will worsen. This is because capital incomes are much more concentrated than labor incomes. This is exactly what has happened since 1973. In the six decades prior to 1973 capital suffered several substantial shocks. During much of that period the economy also grew faster than the return on capital and there was much less growth in inequality. The blows to capital are well known. We had two world wars; we had the great depression; industries and property were appropriated in the post-colonial period and taxes were raised to fund the wars and to rebuild devastated industrial capital. There was also a loss of credibility and authority. For example, the New Deal in the US led to the introduction of social safety net programs, and labor organizations were strengthened.

Piketty makes a further point that will not make conservatives happy. They believe that free markets will produce economic growth and distribute the benefits from growth to everyone. They have been working hard since 1973 to reduce the role of government in the economy and to undue much of what had been done during the New Deal. Piketty reaches a different conclusion. He argues that the growth in inequality would be even greater if market forces were allowed to operate with greater freedom. In the long run pay setters set their own pay. They also are being compensated with capital rather than cash. For example, Jamie Dimon, the CEO of JP Morgan, was just awarded a $20 million package for 2013. His salary was $1.5 million and his restricted stock options amounted to $18.5 million. His board consists primarily of CEO's from other firms who had similar paydays in 2013.

Piketty reaches another conclusion that makes liberals unhappy. He argues that the only remedy for the problem of growing income inequality is a global tax on wealth. It must be global in order to prevent wealthy individuals from avoiding taxes through tax haven countries. Since there would be little support for such a tax in rich countries, or in tax haven countries, that will not happen. Therefore, inequality will continue to grow and social unrest and the weakening democratic forces is also inevitable. Liberals argue that there are alternatives to the politically impossible tax on wealth. Piketty does not believe that any of these small bore changes will have the necessary impact.

Tuesday, January 28, 2014

Soup Kitchens Caused The Great Depression And The Great Recession

Austrian business cycle theory was initially a story about how the boom prior to the Great Depression caused the economy to crash. The theory could not explain the duration of the Great Depression so the Austrians looked for another explanation. They argued that unemployment benefits and other social services kept workers from accepting lower wages. If they had accepted lower wages, the economy would return to full-employment. The Austrian explanation for the Great Depression is very similar to what many conservatives argue today. Government programs prevent the labor market from functioning as it should. Its the "soup kitchen story" all over again.

Keynes did not agree with that argument. He suggested that if wages fell for all workers, prices would also fall. Therefore, real wages would not fall and there was no incentive for business to hire more workers. Price deflation was one of the more difficult problems to solve in the Great Depression. Price deflation also meant that dollars were more valuable. Therefore, debt became more difficult to service. It had to be repaid with more valuable dollars. Debt deflation also contributed to the duration of the Great Depression.

Keynes did not agree with that argument. He suggested that if wages fell for all workers, prices would also fall. Therefore, real wages would not fall and there was no incentive for business to hire more workers. Price deflation was one of the more difficult problems to solve in the Great Depression. Price deflation also meant that dollars were more valuable. Therefore, debt became more difficult to service. It had to be repaid with more valuable dollars. Debt deflation also contributed to the duration of the Great Depression.

What Is Your Position In The Distribution Of Wealth?

This site provides an easy way to determine your net worth. It then relates your estimate to the distribution of wealth in several countries.

Sunday, January 26, 2014

George Will Provides A Lesson On How To Earn A Living Writing Op-Eds

This article by George Will illustrates what you can do to become a successful op-ed writer and TV news show guest. The Washington Post provides this platform to demonstrate his skills. His opinion pieces are widely syndicated to small town newspapers throughout the country.

This article is entitled The Political Exhibitionism of the State of the Union. The first two paragraphs tell us that he does like the State of the Union show and that both parties abuse the opportunity. Apparently, that establishes his objectivity and bipartisanship. He then proceeds to the real purpose of the article. He tells us what President Obama will promote in his address this Tuesday and he tells his audience what they should think about the programs that the president will propose to address the problem of inequality. He is going to talk about inequality to take our attention away from the "inconvenient" failure of the Affordable Care Act. (The use of "inconvenient" is also a reference to Al Gore's "Inconvenient Truth" which has become a derogatory term among conservatives)

He explains that the president will propose funding for pre-school education but, that the real purpose of the program is to provide jobs for certified teachers so that they can pay dues to the Teachers Union that are used to fund Democratic campaigns. Moreover, preschool education doesn't work. He proves this by citing one study, out of hundreds of studies, that concludes that the positive effects disappear by third grade. He then explains that a study from George Mason University proves that all of the studies that show an enduring effect are methodologically flawed. (The Op-Ed writer gets to pick the research needed to support a point and conservative think tanks like George Mason are eager to provide the ammunition)

He then tells us the president will propose a raise in the minimum wage. The minimum wage won't reduce inequality, however, because most of the money goes to households that are above that are flush with cash. There are hundreds of studies about the effect of the minimum wage on income inequality. George Will is writing the article so he gets to select the data that he wants to report.

The president will also propose a plan to increase access to college. He compares increasing college enrollments to the government's mistake when it encouraged those who could not afford mortgages to purchase homes. That caused the financial crisis and increasing access to college for students who can't learn will only turn out more graduates who are unable to get jobs. The government subsidies will only encourage colleges to raise prices.

Will ends his attack on the president's coming State of the Union address, disguised as a general attack on the use of the State of the Union address, by putting a stamp of approval by the Supreme Court on his critique. He refers to three of the conservative justices on the Supreme Court who don't like to attend these events. Justice Scalia was one of the judges who he mentioned. He did not mention that Justice Scalia refuses to read the Washington Post because he thinks that it is too liberal. This tells us a lot about Justice Scalia. He thinks that a paper that employs George Will, Robert Samuelson, Charles Krauthammer, and a host of other conservative reporters is too liberal.

This article is entitled The Political Exhibitionism of the State of the Union. The first two paragraphs tell us that he does like the State of the Union show and that both parties abuse the opportunity. Apparently, that establishes his objectivity and bipartisanship. He then proceeds to the real purpose of the article. He tells us what President Obama will promote in his address this Tuesday and he tells his audience what they should think about the programs that the president will propose to address the problem of inequality. He is going to talk about inequality to take our attention away from the "inconvenient" failure of the Affordable Care Act. (The use of "inconvenient" is also a reference to Al Gore's "Inconvenient Truth" which has become a derogatory term among conservatives)

He explains that the president will propose funding for pre-school education but, that the real purpose of the program is to provide jobs for certified teachers so that they can pay dues to the Teachers Union that are used to fund Democratic campaigns. Moreover, preschool education doesn't work. He proves this by citing one study, out of hundreds of studies, that concludes that the positive effects disappear by third grade. He then explains that a study from George Mason University proves that all of the studies that show an enduring effect are methodologically flawed. (The Op-Ed writer gets to pick the research needed to support a point and conservative think tanks like George Mason are eager to provide the ammunition)

He then tells us the president will propose a raise in the minimum wage. The minimum wage won't reduce inequality, however, because most of the money goes to households that are above that are flush with cash. There are hundreds of studies about the effect of the minimum wage on income inequality. George Will is writing the article so he gets to select the data that he wants to report.

The president will also propose a plan to increase access to college. He compares increasing college enrollments to the government's mistake when it encouraged those who could not afford mortgages to purchase homes. That caused the financial crisis and increasing access to college for students who can't learn will only turn out more graduates who are unable to get jobs. The government subsidies will only encourage colleges to raise prices.

Will ends his attack on the president's coming State of the Union address, disguised as a general attack on the use of the State of the Union address, by putting a stamp of approval by the Supreme Court on his critique. He refers to three of the conservative justices on the Supreme Court who don't like to attend these events. Justice Scalia was one of the judges who he mentioned. He did not mention that Justice Scalia refuses to read the Washington Post because he thinks that it is too liberal. This tells us a lot about Justice Scalia. He thinks that a paper that employs George Will, Robert Samuelson, Charles Krauthammer, and a host of other conservative reporters is too liberal.

Saturday, January 25, 2014

Emerging Market Currencies Versus Dollar And Euro Last Five Days

We have all seen a big decline in stock prices across the globe in the last week. This graph shows the fall in emerging market currencies over the last five days. For example, Argentina's currency has dropped 13.8% versus the dollar. The problem for the emerging markets begins in China. Demand in China for commodities and intermediate products has been driving emerging market exports. China in turn, depends upon demand from Europe and the US for its growth. The global economy is an economy of interdependence.

The Best Discussion Of The Brief History Of Macroeconics That I Have Read

Noah Smith got his undergraduate degree in physics and he decided to pursue a PhD in economics because it interested him. He found that the mathematics that he learned in physics was useful to him since economics had been on a path to emulate what it believed to be science. Since receiving his PhD his blog has focused a lot of attention on the adequacy of economic models in predicting outcomes or explaining real economic phenomena. This article brings many of his ideas together and the comments that follow are thoughtful and provocative. While it is primarily for those with some background in economics, it is written very well and it leads to an important conclusion. The macroeconomy is just to damn complicated to describe mathematically.

One thing that most can take from this article is the war between the Chicago crowd and the so called freshwater economists, is largely a battle over methodology and technique. Both sides use DSGE models to describe the economy. The saltwater DSGE models are used by most central banks in the world but the Chicago models have been dominant in academics. The Chicago group and the freshwater crowd also disagree about an important issue. The Chicago group has build its theory around the assumption that fiscal stimulus by government cannot moderate the business cycle. The freshwater economists tend to support the use of fiscal policy. Consequently, the war between these two schools of thought is practically important.

One thing that most can take from this article is the war between the Chicago crowd and the so called freshwater economists, is largely a battle over methodology and technique. Both sides use DSGE models to describe the economy. The saltwater DSGE models are used by most central banks in the world but the Chicago models have been dominant in academics. The Chicago group and the freshwater crowd also disagree about an important issue. The Chicago group has build its theory around the assumption that fiscal stimulus by government cannot moderate the business cycle. The freshwater economists tend to support the use of fiscal policy. Consequently, the war between these two schools of thought is practically important.

Why We Can't Leave The Problem Of Income Inequality To Economists

Raj Chetty from Harvard led a team of economists who have just released an important study about income inequality and mobility in the US. They found that social mobility has not changed over the last several decades because most of the change in income has been concentrated in the top 20% and even within that group most of the change has occurred within the very top of the pyramid. What we see happening in the US is pretty similar to the distribution of income in other nations as well. The gap between the super-rich and everyone else has been growing at a rapid rate.

Justin Fox, who wrote this article on the Harvard Business Review site, read Greg Mankiw's maddening article on income inequality and he decided that economists have no competence in determining the socially appropriate level of income inequality. Mankiw essentially argued that market forces determine the distribution of income and that little could be done about it. Like most economists, Mankiw excludes moral and social outcomes from his analyses of economic data. That means the our political system must make the moral judgements about the level of inequality that is socially desirable. Unfortunately, our political system has been making the decisions that have led to the maldistribution of income that we have today. Most of the changes in what the "market system" has produced in the distribution of income have occurred in the last few decades. We have allowed the super-rich to shape the market system in its favor.

Justin Fox, who wrote this article on the Harvard Business Review site, read Greg Mankiw's maddening article on income inequality and he decided that economists have no competence in determining the socially appropriate level of income inequality. Mankiw essentially argued that market forces determine the distribution of income and that little could be done about it. Like most economists, Mankiw excludes moral and social outcomes from his analyses of economic data. That means the our political system must make the moral judgements about the level of inequality that is socially desirable. Unfortunately, our political system has been making the decisions that have led to the maldistribution of income that we have today. Most of the changes in what the "market system" has produced in the distribution of income have occurred in the last few decades. We have allowed the super-rich to shape the market system in its favor.

Coca-Cola And Nike Are Worried About Climate Change

Coke and Nike are experiencing water shortages and rising prices in commodities that have been affected by climate change. They have both been forced to adapt to climate change. They are among a group of business leaders that are now worried about the economic effect of climate change on their business models. That is what it takes to get the business community on board in the battle against climate change. Of course coal industry executives will not be happy about this change of heart but business leaders are beginning to worry about the future cost of climate change which will continue to climb as the crisis worsens.

Friday, January 24, 2014

Robert Solow On The Importance Of An Equitable Growth Society

Robert Solow is a Nobel Laureate in economics whose research was on growth theory. He is at the new Center For Equitable Growth in Washington and is given an opportunity in this video interview to tell us why an unequal society is not good for growth, as well as what it might take to become a more equitable society. He believes that the challenge within economics today is to better understand how we can move towards a society that has the goal of growth with greater equity. The 28 minute interview gives him an opportunity tell his story.

We currently have a low growth economy that is increasingly inequitable. That creates supply side as well as demand side problems that will limit future growth. On the supply side, we are eroding our supply of human capital that is essential for growth and innovation. The long term unemployed become unemployable and we lose their economic output. Secondly, those in poverty are unable to develop their capabilities, so we are limiting our pool of innovative talent that is essential for growth. A shrinking middle class also reduces aggregate demand since they have less income to spend. The higher share of income going to those at the top does not create the same level of demand because much of it is funneled into the purchase of financial assets.

One of the barriers to an equitable growth society is the belief that growth is dependent upon a laissez faire economic system that provides powerful financial incentives that reward innovation. Solow argues that we over estimate the power of financial incentives to encourage innovation. Most entrepreneurs are driven by non-financial incentives as well as by financial rewards. There is a reason why someone with $39 million will work hard to get to $40 million and it has little to do with money. We have made the tax system less progressive under the guise that it was necessary to encourage innovation. According the Solow, there is little evidence to support that myth. (We have not been more innovative under a less progressive tax system that we were under a much more progressive tax system that prevailed prior to the 1980's.) Solow argues that economists should be doing more research to learn more about the incentives that encourage innovation.

We currently have a low growth economy that is increasingly inequitable. That creates supply side as well as demand side problems that will limit future growth. On the supply side, we are eroding our supply of human capital that is essential for growth and innovation. The long term unemployed become unemployable and we lose their economic output. Secondly, those in poverty are unable to develop their capabilities, so we are limiting our pool of innovative talent that is essential for growth. A shrinking middle class also reduces aggregate demand since they have less income to spend. The higher share of income going to those at the top does not create the same level of demand because much of it is funneled into the purchase of financial assets.

One of the barriers to an equitable growth society is the belief that growth is dependent upon a laissez faire economic system that provides powerful financial incentives that reward innovation. Solow argues that we over estimate the power of financial incentives to encourage innovation. Most entrepreneurs are driven by non-financial incentives as well as by financial rewards. There is a reason why someone with $39 million will work hard to get to $40 million and it has little to do with money. We have made the tax system less progressive under the guise that it was necessary to encourage innovation. According the Solow, there is little evidence to support that myth. (We have not been more innovative under a less progressive tax system that we were under a much more progressive tax system that prevailed prior to the 1980's.) Solow argues that economists should be doing more research to learn more about the incentives that encourage innovation.

Thursday, January 23, 2014

A Pew Poll Shows That Most American's Favor Income Redistribution

The Pew poll shows that most American's believe that income inequality has grown and that government should do something about it. This article summarizes some of the findings in the Pew poll. It is pretty clear, however, Republicans are very different from Democrats and Independents in their perspective on many key ideas:

* 65% agree that income inequality has grown and 69% believe that government should address the problem

* 54% support raising taxes on wealth to fund safety net programs. Only 35% believe that we should cut taxes on job creators to stimulate growth. Republicans favor cutting taxes on the wealthy by 59% to 29%.

* Republicans also have a different view on the causes of poverty. 65% favor the view that government safety nets make the poor dependent and that poverty is not related to the lack of resources available to the poor. The majority of Americans reject that view. They believe that the poor can be helped out of poverty by making more resources available.

* 73% favor raising minimum wage and 63% favor extending unemployment benefits

* 60% believe that the economy unfairly favors the wealthy. 53% of Republicans believe that the economy is fair.

It is pretty clear from this poll that Republicans are in a minority on most of these issues. That is why they keep stressing the problem of budget deficits. They can get people to agree with them that government should be fiscally responsible. They lose the debate if the conversation can be shifted from deficit reduction to the issue of income inequality and making the tax system more progressive to fund social safety net programs.

* 65% agree that income inequality has grown and 69% believe that government should address the problem

* 54% support raising taxes on wealth to fund safety net programs. Only 35% believe that we should cut taxes on job creators to stimulate growth. Republicans favor cutting taxes on the wealthy by 59% to 29%.

* Republicans also have a different view on the causes of poverty. 65% favor the view that government safety nets make the poor dependent and that poverty is not related to the lack of resources available to the poor. The majority of Americans reject that view. They believe that the poor can be helped out of poverty by making more resources available.

* 73% favor raising minimum wage and 63% favor extending unemployment benefits

* 60% believe that the economy unfairly favors the wealthy. 53% of Republicans believe that the economy is fair.

It is pretty clear from this poll that Republicans are in a minority on most of these issues. That is why they keep stressing the problem of budget deficits. They can get people to agree with them that government should be fiscally responsible. They lose the debate if the conversation can be shifted from deficit reduction to the issue of income inequality and making the tax system more progressive to fund social safety net programs.

European Union Takes A Step Backwards On Environmental Leadership

Europe has been the leader in the battle against climate change. The new rules announced by the European Union is a major step backwards. Its new rule for expanding the use of renewable energy will be very difficult to enforce. Instead of setting targets for individual countries, which can be enforced, it set a target for Europe. That will result in uneven efforts and bickering between countries. Perhaps this was the best deal that could be made among 28 nations that have different priorities. Europe has higher energy costs than other nations against whom it competes economically. Many of the nations within the Union have serious economic problems as well. It is more difficult for Europe to maintain its leadership against climate change under these conditions. Especially when the US and China, which are the largest polluting nations, have been less aggressive in the battle. Its difficult to get politicians to take actions that will be painful today in order to lower the risk of catastrophe for future generations.

Wednesday, January 22, 2014

Hiding Wealth In Offshore Accounts Is Indeed A Global Business

This article names wealthy business people and well connected individuals in China who have used offshore accounts. The accounts have been set up with the assistance of some of our largest global banks who are very good at this sort of thing. It appears that elites in China are not very different from elites elsewhere in the world. They like to avoid taxes and they value the services of wealth managers at our largest banks.

One of the differences between China and most western nations is that its easy to publish this kind of information. The Guardian was not allowed to publish this information in China. I also doubt that individuals in China will have access to this post. We still have some things to be thankful for in the West.

One of the differences between China and most western nations is that its easy to publish this kind of information. The Guardian was not allowed to publish this information in China. I also doubt that individuals in China will have access to this post. We still have some things to be thankful for in the West.

Should The US Follow Europe's Lead And Cap Banker Bonuses?

Europe has taken some steps to limit banker bonuses. The intent is to discourage excessive risks that bankers might take in search of higher returns and larger bonuses. The New York Times asked several commentators to take a position on whether the US should do something similar.

Energy Policies In Europe And Re-industrialization in Europe

This article was written by the CEO of a steel company in Europe who believes that industry has an obligation to reduce CO2 emissions. He also believes that it is important for Europe to restore its strength in the global manufacturing market. He does not think that will happen under the current emissions trading system. He argues that the current ETS unfairly allocates credits to industry, and it is more costly than credit systems in other countries. It represents a tax on industrial production, which along high energy costs in Europe, makes manufacturing in Europe uncompetitive in global markets. Moreover, he argues that renewable energy sources, which are subsidized in Europe, will not meet the requirements for industrial production in the near term.

The timing of this article is a bit strange because prices for emissions credits are falling Europe because of weak demand, and Europe seems to be pulling back on its efforts to reduce carbon emissions. Slow growth and high unemployment in Europe have demanded more attention by politicians. However, this article shows how difficult it is for any nation or political entity to deal with the reduction of carbon emissions on its own. It is a global problem, and it will require a level of global cooperation which we have failed to attain.

The timing of this article is a bit strange because prices for emissions credits are falling Europe because of weak demand, and Europe seems to be pulling back on its efforts to reduce carbon emissions. Slow growth and high unemployment in Europe have demanded more attention by politicians. However, this article shows how difficult it is for any nation or political entity to deal with the reduction of carbon emissions on its own. It is a global problem, and it will require a level of global cooperation which we have failed to attain.

China Is The Fastest Growing Consumer Market In The World

This report from the IMF shows that consumption is growing faster in China than it is in other major economies. China has often been criticized because consumption has been a lower percent of GDP than it is most other economies. Exports and Investment spending have been the driving factors in its economy. In order for consumption to become a larger part of GDP it must grow faster than GDP. It is expected that consumption in China will grow faster than GDP as the services sector expands. Incomes will increase, and consumption will grow faster than GDP and become a larger component of GDP. Growth in services will also be good for the environment. China's manufacturing intensive economy, and its use of coal as a major source of energy, has led to poor air quality in China and it has made China the largest source of CO2 emissions in the world.

The Washington Post And Journalism

Ezra Klein was one of the few people worth reading at the Post. He really understood the issues that he wrote about. Paul Krugman gives his views on how why the Post may have let him leave. I hope that he is wrong. Reporters need to add value to what politicians tell them. They should not be stenographers.

Tuesday, January 21, 2014

Wolfgang Munchau Is Not Pleased By France's Embrace Of Say's Law

Wolfgang Munchau interprets the embrace of Say's Law in France as indication that France is now aligned with Germany on economic policy. He believes that France's economic thinking is now back where it was 211 years ago when Say's dictum that supply creates its own demand was introduced to the world. It implies support for a conventional supply side approach to the problem of inadequate aggregate demand that is favored by Germany. France is now committed to cutting taxes and government spending that is consistent with the austerity program that dominates in the eurozone. It has captured the center left and center right political parities in the eurozone and it is only opposed by those on the far left and far right. According to Munchau, the U turn by France means that the policy debate in the eurozone has been concluded and that there will be little impetus for reform in the governance structure of the eurozone. This means that the nations on the periphery will continue to be forced to swallow the bitter medicine that has been prescribed to address their economic problems.

IMF Raises Global Economic Forecast

This article summarizes the latest global economic forecast by the IMF. It raised its growth forecast for the first time in two years, but warned about the prospect of price deflation which could slow growth and make debt more costly to service. It also provides a snapshot of economic prospects in several countries and regions.

Monday, January 20, 2014

The World Economic Forum At Davos Will Have Growing Income Inequality On Its Agenda

The IMF has raised the issue of growing income inequality and it has been placed on the agenda of the World Economic Forum that is attended by a good segment of the world's leaders. One single statistic on inequality boggles the mind. The 85 wealthiest individuals in world have $1.7 trillion of the world's wealth. That is equal to the share of wealth held by half of the world's population, which includes 3.5 billion people. It will be interesting to see how they deal with this issue.

Will The Financial Crisis Lead To Another Revolution In Macroeconomics?

Simon Wren-Lewis responds to a lecture by Martin Wolf that raised this question. Wolf argued that the Great Depression led to the Keynesian revolution that created macroeconomics. He also argued that the great inflation of the 1970's led to a second revolution. He concluded that the financial crisis should lead to a third revolution.

Lewis agreed that the Great Depression indeed led to a revolution in macro. He is not sure that the great inflation of the 1970's led a revolution in macroeconomics. The intellectual arguments in favor of a microfoundation based macro were powerful, but it may have also have been a counter revolution against Keynesian theory, which raised too many questions about classical economics, and which provided for a more powerful role of the state in the management of the economy.

Lewis believes that there will some tinkering around the edges in macroeconomics, and that he lists some of the tinkering that has been happening. He does believe, however, that the financial crisis was a deadly blow to neoliberal ideology. We deregulated the market and let the unregulated market run its course. Eventually, the state was required to rescue the failed market. There is a strong link, however, between neoliberal ideology and those in political power. Lewis has learned through experience that this link cannot be ignored. He doubts that Wolf's revolution in macro will be forthcoming.

Lewis agreed that the Great Depression indeed led to a revolution in macro. He is not sure that the great inflation of the 1970's led a revolution in macroeconomics. The intellectual arguments in favor of a microfoundation based macro were powerful, but it may have also have been a counter revolution against Keynesian theory, which raised too many questions about classical economics, and which provided for a more powerful role of the state in the management of the economy.

Lewis believes that there will some tinkering around the edges in macroeconomics, and that he lists some of the tinkering that has been happening. He does believe, however, that the financial crisis was a deadly blow to neoliberal ideology. We deregulated the market and let the unregulated market run its course. Eventually, the state was required to rescue the failed market. There is a strong link, however, between neoliberal ideology and those in political power. Lewis has learned through experience that this link cannot be ignored. He doubts that Wolf's revolution in macro will be forthcoming.

Time For A New Theory Of The Firm?

This article argues that our current theory of the firm is flawed. It is necessarily flawed in order to support a flawed theory of markets. This is a direct attack on fundamental principles in microeconomics. It also raises questions about macroeconomic models that assume the correctness of microeconomics. If we don't really understand what drives the investment decisions of firms, the assumptions contained about agent behavior in the models are way off base. For example, we assume that firms operate to maximize profits. The maximization of profits, however, is very different from what firms really do. They operate to maximize the rate of return on investment. Since the outcome of investments is laden with uncertainty, they are made with great care. For example, I worked for a very large computer that had a very high hurdle rate for making investments. The hurdle rate was a 25% return on investment. We set a very high hurdle rate because the technology and market conditions were in a constant state of flux. We knew that many would fail. We needed big payoffs to fund the losers. The hurdle rate was not set in stone, however. If the CEO had a pet project in mind, it would get funded. We spent over $1 billion on a failed project that our CEO insisted upon because he believed that it was necessary to overtake the largest firm in the the industry. He was not content at the number two position. Also our pricing decisions had nothing to do with our marginal costs. We had no idea what our marginal costs would be. Our prices were usually a markup over the cost of the first product that we manufactured. Some firms engage in value pricing. That is, they estimate the value of the product to the consumer and try to capture the largest share of that value as they can. In other words, the textbook treatment of the pricing behavior of firms is a gross simplification of the varied and complex processes that actually exist in practice.

This article gets a bit technical but it makes a point worth considering. The prevailing theory of the firm is inadequate. It is no wonder that there is no good explanation of the business cycle that has any predictive power.

This article gets a bit technical but it makes a point worth considering. The prevailing theory of the firm is inadequate. It is no wonder that there is no good explanation of the business cycle that has any predictive power.

Sunday, January 19, 2014

Youth Unemployment In Europe

This graph (click to enlarge) shows the effect of the financial crisis on youth unemployment in Europe. It is not restricted to periphery countries that have been most harmed by the consequences of the financial crisis. It will also affect the future of the youth and the European economy. Young people will not be acquiring the skills that are only learned on the job and normal paths for household formation will be disrupted.

The Business Of Medical Practice

The least well compensated physicians in the US are the kind that are most needed. They are the general practitioners who manage the medical care of their clients. This article explains why most physicians decide to specialize in performing medical procedures. That is where the money is. They not only get paid for performing the procedures, but many physicians have invested in diagnostic devises of various sorts; they have an incentive maximize their return on investment. Too many physicians have become entrepreneurs. They also employ lobbyists in Washington that look out for their financial interests. Medical costs in the US are much higher than they are in any other country. It is clearly unlike any other kind of market that we are familiar with. Consumers don't really know what they are purchasing and prices are not available to them at the time of purchase. Conservatives insist that it is really a market, and that prices can be driven down by smart consumers and competition between providers. Liberals are primarily concerned about increasing access to healthcare, and most of their efforts to reduce costs are either short sighted or blocked by politicians who accuse them of playing God by deciding what government insurance will pay for a procedure and what procedures will be approved. Nobody in their right mind would design a system like the one we have in the US, but we have a political system that is not well designed to make major changes.

Friday, January 17, 2014

David Brooks Reframes The Income Inequality Problem

Its a mistake to focus on the problem of income inequality according to Brooks. That is because income inequality is a consequence of other factors. We will always have the poor with us because they are deficient in human capital. It is passed on from generation to generation. Unless we take steps to improve their human capital the problem can't be solved. Moreover, we can't do much to alter the fact that the top 5% are being rewarded highly for their work, and there is no reason to focus on reducing their incomes. That is because the share of income going to the top 5% does not affect the incomes at the bottom. Democrats and Republicans agree that we should make an effort to improve human capital formation so we should work on improving human capital formation and stop all of this nonsense about growing income inequality. Above all we should not advocate solutions to the problem that are unrelated to the causes of income inequality. Raising the minimum wage is a bad idea because he selected two studies, out of numerous studies on the minimum wage, which conclude that raising the minimum wage is unproductive. It is also a mistake to argue that the unequal distribution of income leads to an unequal distribution of political power. We should avoid at all costs any discussion of class power. Apparently, we live in a country with growing income inequality that is unrelated to class power.

There are so many mistakes in Brooks' analysis of income inequality that is hard to know where to begin. I have selected just a few of his most egregious mistakes for discussion.

Brooks frames the income inequality problem in a way that ignores the middle class. Median income growth has been stagnant for decades while almost all of the growth in income has gone to the 5%. Even within the top 5%, the lion's share of income growth has gone to those at the very top of the pyramid. Clearly, this is not a problem of inadequate human capital formation in the middle class. If we were able to greatly improve human capital formation within the lowest 20% of the population they would be competing for a shrinking share of income going to the middle class. In fact, I posted an earlier article by Brooks in which he argued that the real problem of income inequality was between middle class Americans who have more human capital than those in poverty. Brooks has absolutely no interest in discussing the rapidly increasing share of the income pie that that is going to very top of the income distribution. That would be class warfare, but it is not class warfare to discuss the advantages that middle class Americans have over those in poverty.

Brooks is correct in arguing that income inequality is growing across the globe. Therefore, it is pointless to focus our attention on income inequality in America. That is a serious error because it only applies to pre-tax income. Income after taxes in the US is much higher than it is in other Western societies, with high pre-tax income inequality, because they have highly progressive tax systems. Moreover, the US tax system has become less progressive in recent years. We have lowered the top marginal tax rate on earned income and we have greatly reduced the tax on capital gains and dividends. Of course, according to Brooks this has nothing to do with the influence that the wealthiest Americans have over tax policy. To argue otherwise would be class warfare because it directed against those at the top of the pyramid. Class warfare according to Brooks in unidirectional. Those at the top of the hierarchy never use their power to gain advantage over those below them. However, any effort to restore the progressiveness of the tax system would be class warfare.

To summarize, Brooks has done his job as well as he can. He has reframed the discussion of income inequality in way that deflects our attention from the concrete problem of growing income inequality to the problem of human capital formation among our poorest citizens. This also diverts our attention from two of the most effective means to reduce income inequality. That is, raising the minimum wage and using tax policy to reduce post-tax income inequality. His focus on human capital formation is also specious because he ignores the efforts of his favorite political party to cut spending on programs that might support human capital formation. It is no wonder that Brooks has become one of our most visible opinion leaders. He is more effective at defending the interests of his class than most of those on the right who lack his rhetorical skill.

There are so many mistakes in Brooks' analysis of income inequality that is hard to know where to begin. I have selected just a few of his most egregious mistakes for discussion.

Brooks frames the income inequality problem in a way that ignores the middle class. Median income growth has been stagnant for decades while almost all of the growth in income has gone to the 5%. Even within the top 5%, the lion's share of income growth has gone to those at the very top of the pyramid. Clearly, this is not a problem of inadequate human capital formation in the middle class. If we were able to greatly improve human capital formation within the lowest 20% of the population they would be competing for a shrinking share of income going to the middle class. In fact, I posted an earlier article by Brooks in which he argued that the real problem of income inequality was between middle class Americans who have more human capital than those in poverty. Brooks has absolutely no interest in discussing the rapidly increasing share of the income pie that that is going to very top of the income distribution. That would be class warfare, but it is not class warfare to discuss the advantages that middle class Americans have over those in poverty.

Brooks is correct in arguing that income inequality is growing across the globe. Therefore, it is pointless to focus our attention on income inequality in America. That is a serious error because it only applies to pre-tax income. Income after taxes in the US is much higher than it is in other Western societies, with high pre-tax income inequality, because they have highly progressive tax systems. Moreover, the US tax system has become less progressive in recent years. We have lowered the top marginal tax rate on earned income and we have greatly reduced the tax on capital gains and dividends. Of course, according to Brooks this has nothing to do with the influence that the wealthiest Americans have over tax policy. To argue otherwise would be class warfare because it directed against those at the top of the pyramid. Class warfare according to Brooks in unidirectional. Those at the top of the hierarchy never use their power to gain advantage over those below them. However, any effort to restore the progressiveness of the tax system would be class warfare.

To summarize, Brooks has done his job as well as he can. He has reframed the discussion of income inequality in way that deflects our attention from the concrete problem of growing income inequality to the problem of human capital formation among our poorest citizens. This also diverts our attention from two of the most effective means to reduce income inequality. That is, raising the minimum wage and using tax policy to reduce post-tax income inequality. His focus on human capital formation is also specious because he ignores the efforts of his favorite political party to cut spending on programs that might support human capital formation. It is no wonder that Brooks has become one of our most visible opinion leaders. He is more effective at defending the interests of his class than most of those on the right who lack his rhetorical skill.

Thursday, January 16, 2014

A Global Report Card On Government Failure And Threats To Democracy

"Though the conundrum of patronage-based elections under imperfect institutions has no simple solution, a good case can be made that the way to increase the inclusivity of political institutions is not to ignore the ballot box, but to utilize it, together with protests when necessary. But so long as elites and a vocal minority refuse to accept electoral results they don’t like, the path to a healthy democracy and truly inclusive institutions will be long, arduous and perhaps blocked for a long time"The above quote is the concluding paragraph in an article which reviews the tensions between governments and its citizens. There is a growing discontent in many countries about the ability of elected leaders to deal effectively with problems. This discontent takes different forms across the globe. In some cases protests are an effective response to the failures of elected leaders. In other cases, a refusal to accept the results of elections represents a greater threat to democracy itself. For example, the military has replaced elected leaders in Egypt.

Democracy is not perfect, and the level of democratic maturity differs widely across the world, however, even in mature democracies, like the US, the level of discontent with government is very high. The electoral process has been under attack, and corrupted, in number of ways; there is also less acceptance of the results of elections. Simultaneously, the problems faced by governments have also become more difficult to manage. Western nations are still dealing with the fall out from the financial crisis and high levels of unemployment and growing inequality which are unprecedented in the last half century. Governments also have to deal with the problem of global warming which has no easy solutions. There are also concerns about how to protect ourselves from terrorism while retaining the civil liberties that we value. Changes in our communication systems have also put more pressure on governments. Every misstep by government is put under a spotlight, and it is easier to spread misinformation as well information to the public.

Why Do Workers In Red States Vote Against Government Regulations?

One explanation for Robert Reich's question is that workers in Red States vote on cultural and value issues. That may be part of the reason, but the other reason is economic. The red states are able to attract businesses and jobs to their states by being "business friendly". When jobs are scarce workers vote in their economic interest.

Reich does not consider another question that is related to the issue that he raised. That is, why might business leaders prefer a less than full-employment economy? One might expect that more growth and output is in their interest. That may not be true. For example, corporate profits in the US have been at an all time high under conditions of high unemployment. To some extent, the high profits are the result of stagnant growth in wages. It is easier to control wage growth when we do not have full-employment. At a deeper level, it also gives business leaders more power in relation to government officials. Politicians understand the importance of jobs. In every state, and in every nation, they are in competition with each other to attract jobs to their area of responsibility. That is only possible when jobs are a scarce commodity. Full employment would be very bad for business. One of the benefits of globalization is that it is easier for businesses to move jobs from places with high levels of employment, and high wages, to locations with higher unemployment and lower wages. They can also do so without worrying about the loss of consumer demand in areas that they vacate. They can replace the demand in mature markets with demand in more rapidly growing markets.

Reich does not consider another question that is related to the issue that he raised. That is, why might business leaders prefer a less than full-employment economy? One might expect that more growth and output is in their interest. That may not be true. For example, corporate profits in the US have been at an all time high under conditions of high unemployment. To some extent, the high profits are the result of stagnant growth in wages. It is easier to control wage growth when we do not have full-employment. At a deeper level, it also gives business leaders more power in relation to government officials. Politicians understand the importance of jobs. In every state, and in every nation, they are in competition with each other to attract jobs to their area of responsibility. That is only possible when jobs are a scarce commodity. Full employment would be very bad for business. One of the benefits of globalization is that it is easier for businesses to move jobs from places with high levels of employment, and high wages, to locations with higher unemployment and lower wages. They can also do so without worrying about the loss of consumer demand in areas that they vacate. They can replace the demand in mature markets with demand in more rapidly growing markets.

Why Have Modern Economies Become Dependent Upon The Wrong Kind Of Debt?

Adair Turner has observed the negative effects of the extensive use of debt in the global economy over the last few decades. Public and private debt has grown much more rapidly than GDP or income and he asks whether there is something wrong with modern economies. Why is adequate demand growth dependent upon damaging debt growth?

He points to three issues that may be at the root of our economic problem. In the first place, much of the debt is used to purchase existing assets. It is not being used to expand productive capacity. Stock prices and the prices of existing homes rise but jobs are not being created. This creates a wealth effect that stimulates consumption without addressing the drivers of income inequality which makes consumption dependent upon debt. He also argues that global imbalances are part of the problem. We have creditor nations and debtor nations that result from trade imbalances. These imbalances are not sustainable. There has been a huge expansion of debt that is not being used to create sufficient demand. It is being used for the wrong purposes.

He points to three issues that may be at the root of our economic problem. In the first place, much of the debt is used to purchase existing assets. It is not being used to expand productive capacity. Stock prices and the prices of existing homes rise but jobs are not being created. This creates a wealth effect that stimulates consumption without addressing the drivers of income inequality which makes consumption dependent upon debt. He also argues that global imbalances are part of the problem. We have creditor nations and debtor nations that result from trade imbalances. These imbalances are not sustainable. There has been a huge expansion of debt that is not being used to create sufficient demand. It is being used for the wrong purposes.

Wednesday, January 15, 2014

The Three Failures That Threaten Modern Society

Martin Wolf, writing in the Financial Times captured much of what has been going wrong in the western world. We don't expect that our elite leaders will get things exactly right, but we are in trouble when they get things terribly wrong. They got things terribly wrong in the first half of the 20th Century as Europe tore itself apart by mismanaging wars fed by grandiose concepts of empire. Today our elites are mismanaging peace instead of war. Wolf argues that our elites have made three major mistakes that are feeding right wing populism.

The first failure was the failure to understand the consequences of uncontrolled financial liberalization. Elites believed in the virtues of debt expansion which required governments to rescue the financial system. This was necessary but it was not popular. Those who benefited most from the mistakes that were made benefited most from the rescues made by taxpayers.

The second problem is globalization has weakened the notion of citizenship. Plutocracy is a necessary outcome of capitalism but it has become exaggerated today. The benefits of globalization go to a narrow elite and the distance between the elite and ordinary citizens has broken the bonds between the plutocrats and everyone else.

The third problem is most visible in the European Union. Elected leaders in the most distressed countries are accountable to their citizens but they are powerless to act. Power has been concentrated in creditor nations and in unelected technocrats in Brussels, Frankfort and the IMF who are not accountable to the citizens of the troubled countries.

The powerlessness that is experienced by many as a result of elite mismanagement has created a vacuum that can lead to unintended consequences in our political and social systems. Our elites have created a mess that will not be easy to rectify.

The first failure was the failure to understand the consequences of uncontrolled financial liberalization. Elites believed in the virtues of debt expansion which required governments to rescue the financial system. This was necessary but it was not popular. Those who benefited most from the mistakes that were made benefited most from the rescues made by taxpayers.

The second problem is globalization has weakened the notion of citizenship. Plutocracy is a necessary outcome of capitalism but it has become exaggerated today. The benefits of globalization go to a narrow elite and the distance between the elite and ordinary citizens has broken the bonds between the plutocrats and everyone else.

The third problem is most visible in the European Union. Elected leaders in the most distressed countries are accountable to their citizens but they are powerless to act. Power has been concentrated in creditor nations and in unelected technocrats in Brussels, Frankfort and the IMF who are not accountable to the citizens of the troubled countries.

The powerlessness that is experienced by many as a result of elite mismanagement has created a vacuum that can lead to unintended consequences in our political and social systems. Our elites have created a mess that will not be easy to rectify.

Tuesday, January 14, 2014

Is The Safety Net Just Masking Tape In Our Response to Poverty?

The Republican party is actively engaged in reducing social safety net programs. That, of course, is what it means to be a conservative. It has always been their role in society. That was what prisons and workhouses were for according to Dicken's Ebenezer Scrooge in an earlier era. The Democratic Party is in the position of resisting the attack on social safety net programs. That is consistent with the liberalism that has characterized the Party since FDR. The public has to decide whether conservatives are correct in asserting that social safety net programs prevent people from seeking employment, or lifting themselves up from their bootstraps which aren't as useful as the bootstraps that are available to those who have been luckier to have been born with better bootstraps. That is, are social safety net programs responsible for social immobility and poverty?

The argument in this article is that social safety net programs are a necessary but not a sufficient condition for dealing with the problem of poverty. As long as we have high unemployment, and growing income inequality, the hollowing out of the middle class will continue and the erosion of support for social safety net programs will accelerate. The article includes some suggestions about what might be done increase employment opportunities and maintain the middle class which is a requirement for an effective democracy.

The argument in this article is that social safety net programs are a necessary but not a sufficient condition for dealing with the problem of poverty. As long as we have high unemployment, and growing income inequality, the hollowing out of the middle class will continue and the erosion of support for social safety net programs will accelerate. The article includes some suggestions about what might be done increase employment opportunities and maintain the middle class which is a requirement for an effective democracy.

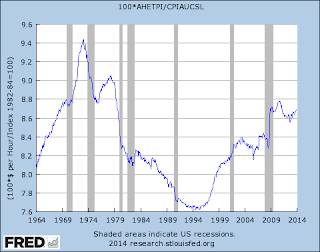

Real Wages For Non-Supervisory Production Workers Lower Than They Were In 1973

There has been a lot of debate about raising the minimum wage in the US. This graph (via Paul Krugman) depicts the changes in the average real hourly wage since 1964. The period between 1964 and 1973 was a period of rapid wage growth. The real hourly wage hit its peak of $9.4 in 1973. It dropped rapidly to a trough in 1994 when it hit bottom at $7.6. It rose during the dotcom boom in the Clinton era to $8.4 and it is currently at $8.6. Hourly workers were much better off in 1973 than they are today. During this period the economy has grown substantially but economic growth has not benefited the wages of hourly workers. Curiously, the fastest growth in wages were occurred during the 60's and early 70's which was a period of social unrest. The Reagan era in the 80's, which is reputed to have been favorable for economic growth, was not good for hourly wages. The upward trend in the Clinton era was a period of very low unemployment. Wage growth is usually better when the demand for labor is greater than the supply. There are no indications that the real hourly wage will continue to head upwards under current conditions. Moreover, there is no indication that Congress will agree to increase the minimum wage that has been requested by the Obama Administration.

Monday, January 13, 2014

Why Do Some Economists Reject Government Efforts To Reduce Unemployment?

Paul Krugman has been very critical of economists who have rejected the idea that government can take actions which will reduce unemployment without creating other problems. He portrays this as an anti-scientific revolution within economics. It is anti-scientific in his mind because most of the claims made against government efforts to reduce unemployment have been shown to be wrong. He believes that this should persuade economists to change their minds. In fact, prominent economists, like Robert Barro at Harvard have argued that there is no such thing as insufficient aggregate demand. His system of economics focuses entirely on the problem of inadequate supply. In response Krugman points out that there is no evidence that supply factors should have led to our extended period of high unemployment. He also points us to other claims that have been proven to be wrong:

* We were told that the Fed can't print money without causing inflation. The Fed has been printing money and there are no signs of inflation.

* We were told that government could not run budget deficits without driving up interest rates because government would be reducing the supply of funds required for business investment. In fact, government deficits have not led to higher rates of interest for private investments.

* We were told that government can't increase public spending without reducing private spending. Government would be competing for the use of scarce resources that would not be available for private spending. In fact nations with higher levels of government spending have had higher levels of private spending.

Krugman has been pointing these inconsistencies out for some time yet they continue. However, it may not indicate an anti-scientific revolution as he indicates. The false assumptions that he attacks are consistent with an economic doctrine that has been resistant to counter evidence for many years. It is the world's most powerful religion without a church. Faith in the religion is a powerful force because it is also consistent with many of the ethical beliefs that underlie our economic system. For example, "sound government finance" is necessary for business confidence; you can't pay people not to work; private investment is superior to government investment etc. etc. We should regard the business cycle as a normal state of affairs. The maintenance of a full-employment economy is not the objective of the economy. We should only expect full-employment at the peak of the cycle and the slumps will be mild and short lived as long as government does not interfere with the economy.

* We were told that the Fed can't print money without causing inflation. The Fed has been printing money and there are no signs of inflation.

* We were told that government could not run budget deficits without driving up interest rates because government would be reducing the supply of funds required for business investment. In fact, government deficits have not led to higher rates of interest for private investments.

* We were told that government can't increase public spending without reducing private spending. Government would be competing for the use of scarce resources that would not be available for private spending. In fact nations with higher levels of government spending have had higher levels of private spending.

Krugman has been pointing these inconsistencies out for some time yet they continue. However, it may not indicate an anti-scientific revolution as he indicates. The false assumptions that he attacks are consistent with an economic doctrine that has been resistant to counter evidence for many years. It is the world's most powerful religion without a church. Faith in the religion is a powerful force because it is also consistent with many of the ethical beliefs that underlie our economic system. For example, "sound government finance" is necessary for business confidence; you can't pay people not to work; private investment is superior to government investment etc. etc. We should regard the business cycle as a normal state of affairs. The maintenance of a full-employment economy is not the objective of the economy. We should only expect full-employment at the peak of the cycle and the slumps will be mild and short lived as long as government does not interfere with the economy.

Sunday, January 12, 2014

What Happens To Democracy When Congress Becomes A Millionaire's Club?

The answer to that question is that Congress represents the interests of its peer group. This is pretty clear when one looks at tax policy and spending policy. Tax policies have become less progressive and Congress is more concerned about cutting social programs to reduce budget deficits than it is in making tax policy more progressive. This is not an easy problem to solve. It has become more expensive to run for office and it has become easier for the super-rich to fund elections. Unless things change, democracy in America may become more like it is in third world countries. Most of them have elections but the policies don't change much.

The Irish Success Story In Perspective

Irish Banks borrowed a ton of money from European banks to fund its real estate boom. The real estate bubble burst and the Irish banks were unable to service its debt. The Irish government decided to guarantee the debt. That helped the European banks but it caused the Irish government to cut back drastically on spending. That was supposed to reduce Ireland's debt to GDP ratio, but the cuts in spending made the ratio worse. The Irish debt is being divided by a much smaller GDP. This is not a very good success story but those who sold Ireland on its austerity program still hail it as a success.

Another part of the Irish success story is its ability to attract high tech American companies to locate in Ireland. They are attracted by the low tax rates and access to European markets from Ireland. Outside of Dublin, however, is another Irish economy in which 25% of Irish households do not have a single employed person bringing in wages. Ireland's biggest export has been the emigration of its educated population to countries with better job opportunities. The Irish success stories continue, however, those who sold Ireland on austerity have a desperate need to use Ireland as a role model.

Another part of the Irish success story is its ability to attract high tech American companies to locate in Ireland. They are attracted by the low tax rates and access to European markets from Ireland. Outside of Dublin, however, is another Irish economy in which 25% of Irish households do not have a single employed person bringing in wages. Ireland's biggest export has been the emigration of its educated population to countries with better job opportunities. The Irish success stories continue, however, those who sold Ireland on austerity have a desperate need to use Ireland as a role model.

Does Ending Unemployment Benefits Increase Employment?

Ever since governments provided provided benefits to the unemployed it was attacked by those who claimed that it would encourage workers to remain unemployed. North Carolina provides a good example of what happens when the government is taken over by conservatives who share that belief. This article shows what has happened in North Carolina after the government shut down unemployment benefits. The labor force participation rate dropped below the national average, and the unemployment rate increased. We can expect more of these kinds of policies at the state level as conservatives strengthen their hold on governments in most of the Red states. Conservatives have figured out that they can accomplish things at the state level that they have difficulty accomplishing at the national level.

Saturday, January 11, 2014

Why Aren't Democrats In The Senate More Outraged About Republican Efforts To Deal With Labor Policy

Dana Milbank attended a Senate meeting in which Democratic Senators passed up a large opportunity to distance themselves from Republicans who have opposed labor policies that might improve conditions for the unemployed or underemployed. Democratic leaders in the Senate appeared to be less motivated about advancing their proposals than the Republicans who want to block them.

A Conservative Economist Has Some Suggestions To Advance The War On Poverty