This New Year's eve will be special. In addition to watching the end to 2012 celebrated in Time Square, we may also get to go over the fiscal cliff together. That is a new feature of American Exceptionalism. It is a gift from our exceptional Congress.

Happy New Year.

Monday, December 31, 2012

Sunday, December 30, 2012

The Painless Way To Reduce Budget Deficits Is To Decrease The Unemployment Rate

We are being told by very serious people that we must inflict pain on ourselves to save the nation from future bankruptcy. We all know that medicine only works when it it tastes bad, or when it is painful, therefore; common sense tells us that we should get ready for a dose of pain. This article suggests that we have already endured the pain. Cuts in private spending, or belt tightening, is painful and we have done that. Our national savings rate has doubled during our current recovery. Now we are being told that more pain is needed before we can be redeemed for our sins. That is, government spending on entitlements must be cut as well. That is we should do what Japan did to deal with budget deficits and cut federal spending. That would be a good idea if we want the same result that Japan got from its austerity program. The pain was real but their economy got worse.

The article provides several graphs which point us in the direction that we should be taking, and does not require painful medicine. The correlation between the unemployment rate and federal budget deficits is remarkably high. The best way to reduce budget deficits may be to create jobs for the unemployed.

Another form of medicine that is being proposed is also painful for those with high incomes. Raising their taxes is painful, but it won't do much to reduce budget deficits. If we want to reduce growing income inequality, we should make the tax system more progressive, but it is not a good solution for reducing budget deficits.

We tend to lump Social Security along with Medicare and Medicaid when we talk about entitlement reform. We would be better off if we focused on the real driver of future increases in government spending. It is healthcare price inflation. That rate has been slowing down in the last three years and that is good sign. The Affordable Healthcare Act may slow the price inflation rate as well. In any case, reducing healthcare price inflation should receive most of our attention.

The article provides several graphs which point us in the direction that we should be taking, and does not require painful medicine. The correlation between the unemployment rate and federal budget deficits is remarkably high. The best way to reduce budget deficits may be to create jobs for the unemployed.

Another form of medicine that is being proposed is also painful for those with high incomes. Raising their taxes is painful, but it won't do much to reduce budget deficits. If we want to reduce growing income inequality, we should make the tax system more progressive, but it is not a good solution for reducing budget deficits.

We tend to lump Social Security along with Medicare and Medicaid when we talk about entitlement reform. We would be better off if we focused on the real driver of future increases in government spending. It is healthcare price inflation. That rate has been slowing down in the last three years and that is good sign. The Affordable Healthcare Act may slow the price inflation rate as well. In any case, reducing healthcare price inflation should receive most of our attention.

Saturday, December 29, 2012

Implications Of A Decline In Labor's Share Of Income

Most of our attention has been focused on our short term business cycle. The recovery has been slower than our typical recovery from recessions and economists differ on how to explain the slow recovery and what should be done about it. This article raises a concern about longer term policy issues. In particular, it focuses on how we fund Social Security. It is funded by taxes on earned income under a ceiling, which today is $110,000, but which increases with the rate of inflation. Our long term projections of government's ability to fund Social Security is based upon assumptions about the growth of the economy, and the distribution of income. If the share of income going to capital increases faster than labor income, Social Security funding will decline because most of the growth in income will be above the income ceiling. That explains why many want to cut Social Security benefits. The choice is between a cut in benefits, or changing the method of funding. Those with incomes above the ceiling, prefer benefit cuts to raising the income ceiling.

It is likely that the growth in income inequality will follow the current trend. Capital's share of national income will grow as capital replaces labor, and labor income falls relative to capital income. The nation will be richer, and able to afford Social Security benefits at the projected benefit levels, but not with the current method of funding which depends upon more equal growth in capital and labor income.

It is likely that the growth in income inequality will follow the current trend. Capital's share of national income will grow as capital replaces labor, and labor income falls relative to capital income. The nation will be richer, and able to afford Social Security benefits at the projected benefit levels, but not with the current method of funding which depends upon more equal growth in capital and labor income.

Consider Your Mancard Reissued. Buy An Assualt Weapon

This op-ed shows that the firearms industry understands the motivations of many who purchase assault weapons. It describes some of the ads, and images, on the web pages and catalogs of the manufacturers. Bushmaster shows troops in full combat gear armed with an assault weapon. Bushmaster deleted the ad on their web page which told purchasers that buying an assault weapon "reissued their mancard" after the Newtown massacre. Apparently, they saw the connection between the fantasies to which they appeal and the Newtown assailant. People who believe that their manhood has been threatened are dangerous. Most do not commit murder to reissue their manhood. but 100,000 murders are committed annually in the US. Many of them are by men who asserted their manhood.

Friday, December 28, 2012

Why Did Cancer Treatment Centers Of America CEO Give $12 Million To Freedom Works?

Richard Stephenson is the founder and CEO of CTCA which is a for-profit organization that targets people with late stage cancer. Stephenson contributed $12 million to Freedom Works which provides funding for the Tea Party. He did this through an anonymous third party organization. I was puzzled by the relationship between CTCA and Freedom Works until I learned that Medicare does not pay for CTCA services to its patients. Although Stephenson has been active in right wing organizations along with the Koch Brothers, he may also have a financial interest in blocking the expansion of Obamacare. Private insurers are the source of funding CTCA patients.

The comments following this post about CTCA are also revealing. It targets desperate cancer patients with sleazy ads which suggests that they can provide treatments and patient care which are not available in hospitals. CTCA is the sub prime lender of the hospital industry.

The comments following this post about CTCA are also revealing. It targets desperate cancer patients with sleazy ads which suggests that they can provide treatments and patient care which are not available in hospitals. CTCA is the sub prime lender of the hospital industry.

What's Driving Purchase Of US Treasury Bonds?

This graph shows that fixed income investors substituted AAA rated mortgage bonds for US Treasury bonds during the housing bubble. The market for mortgage bonds shrunk dramatically when the housing bubble and securitization market collapsed. Fixed income investors have increased their purchase of US Treasury bonds as a result. Lower yielding Treasuries have replaced the demand for mortgage bonds. Apparently, there is a large market for low risk fixed income securities. Moreover, these data show that the purchase of government debt does not "crowd out" out the private debt market and drive up private interest rates, and reduce business investment, as many economist assume. There is a large market for risk free debt that depends upon US treasuries in the absence of alternative low risk securities.

Thursday, December 27, 2012

The Dean Of NYU's Business School Shows Us How To Earn $1,200 Per Hour

Glenn Hubbard, is a prominent economist who, in addition to being the Dean of NYU's business school, was Mitt Romney's chief economics adviser. He has made an exceptional living supplementing his academic salary by lending his name,and the reputation of his academic position, to those who can afford his hourly rate. He was exposed in the film Inside Job as one of the highest paid expert witnesses available in the market for expert witnesses on economics subjects. Matt Taibbi caught him at his game as expert witness for Countrywide. Hubbard testified that his research showed the Countrywide was not at fault when in originated bad mortgages during that led to its demise. Hubbard's research showed that Countrywide's default rates were no worse than those of a control group. What he did not say in his testimony, was that the control group, that he used in his "research", was doing the same faulty underwriting as Countrywide had done. Under cross examination, Hubbard was forced to admit that he failed to inform the court about the similarities between his control group and Countrywide. He was also forced to admit that he had not bothered to examine the underwriting process that Countrywide used to originate the bad mortgages. It was not easy for the cross examining lawyer to squeeze these admissions from Hubbard, but he succeeded after considerable efforts by Hubbard to evade the direct questions that he was asked. Hubbard's efforts to evade the direct questions which undermined his testimony, showed why he is worth $1,200 per hour. It took an expert attorney to expose his "research" for what it was.

US Head Of Environmental Protection Agency Resigns

After four years heading the EPA which was under constant attack by the energy industry and its supporters in Congress, its leader has called it a day. This article describes some her accomplishments, and her rocky road, heading an agency that lost much of its political support in Washington as the financial crisis, and recession, took the center stage. Perhaps with the 2012 election over, the EPA will get more attention from the White House.

Cultural Versus Political Explanations For National Failure

There has been a lot of speculation about the effects of culture on national survival and collapse. There are also other explanations of that phenomenon. The Philippines is the subject of this essay. A popular book has been written which argues that the culture of the Philippines has been an impediment to national progress. Another explanation, advocated in this essay, is that the political organization of the state is the culprit. The argument is that the state has been captured by an oligarchy which rules in its own interest. It also suggests that the Marcos dictatorship was a failed effort to rid the country of an entrenched oligarchy. The new government in the Philippines is the restored oligarchy.

I know little about the history of the Philippines, but it seems to me that culture and political organization are not mutually exclusive. For example, the oligarchy in the Philippines would certainly have reinforced cultural institutions that contributed to its hold on political power. Therefore, cultural factors, and political organization, would both contribute to the lack of social progress in the Philippines. My guess is that the current oligarchy in the Philippines is very supportive of cultural traditions which contribute to its control of the political institutions in the Philippines.

I know little about the history of the Philippines, but it seems to me that culture and political organization are not mutually exclusive. For example, the oligarchy in the Philippines would certainly have reinforced cultural institutions that contributed to its hold on political power. Therefore, cultural factors, and political organization, would both contribute to the lack of social progress in the Philippines. My guess is that the current oligarchy in the Philippines is very supportive of cultural traditions which contribute to its control of the political institutions in the Philippines.

Wednesday, December 26, 2012

34 Graphs That Describe The Economy in 2012

This set of graphs and explanations (via Manan Shukla) is more informative than most end of year reviews.

Residential Investment And The Business Cycle

This graph (click to enlarge) from Calculated Risk, shows the critical role of residential investment in the business cycle. Consumption is a much larger share of GDP, but it is stable relative to private investment, which is volatile. Declines in residential investment usually occur prior to recessions, and they tend to lead the recovery from recessions. The huge decline in residential investment makes it unique relative to previous post WW ll recessions. We are still waiting for residential investment to trigger a sharper recovery. It looks like that might be happening. Today's report on the increases in home prices is also encouraging. The major risk to a sharper recovery is political. Our dysfunctional political system is our major concern.

The Conservative Case For The Welfare State

Bruce Bartlett held senior staff positions in the Reagan and G.H. Bush administrations. In this article he explains why the welfare state is consistent with conservative goals, and he debunks several conservative myths about social welfare programs in the US. He also takes aim at the high cost of healthcare in the US. If healthcare spending relative to GDP in the US was similar to spending on universal healthcare in the UK, the US could eliminate the social security tax. That should appeal to conservatives who want to reduce taxes.

The Cleveland Clinic's Approach To Better Outcomes At Lower Cost

This article provides an overview of how the Cleveland Clinic has organized itself to increase patient outcomes while reducing costs. Like the Mayo Clinic, doctors are on salary, and they work in teams to coordinate care among specialists. Salary increases at the Cleveland Clinic are based upon patient outcomes. The Clinic also uses lower cost procedures and materials when they achieve equal or better results than more expensive alternatives.

Tuesday, December 25, 2012

Firearm Manufacturers Partner With Video Game Firms

Video games often feature real weapons available on the market. Some of the games have links to the weapons manufacturers. Several of the games provide virtual target practice using assault weapons. The US military has also recruited active gamers. Since the number of mass murders using firearms is not very large, it would be difficult to establish a causal link between video games and mass murders. There are obviously a vast number of gamers who do not commit crimes. On the other hand, the Columbine murderers were active gamers, and the mass murderer in Norway used video games to hone his skills with firearms. There is a powerful link between violent video games and the sale of firearms. Video games contribute to a culture of violence and familiarity with dangerous weapons. There is a reason why the military recruits gamers, and why firearm firms use them in their marketing.

Monday, December 24, 2012

Tom Friedman Is Looking For A Republican Bill Clinton

Bill Clinton saw the handwriting on the wall and decided to capture the political center so that Democrats could win elections. Tom Friedman offers his description of what is left of the GOP, and suggests that they find their Bill Clinton so that we can put an end to political dysfunction in the US. Some Republicans understand the need for moderation, but they argue that the Democratic Party already occupies the political space that Friedman described.

Sunday, December 23, 2012

Is There A Relationship Between GDP Growth And Well-Being? g

The relationship between growth in GDP and well-being has been the subject of much research. Several nations have taken steps to included measures of well- being or happiness along with measures of GDP. This article reviews some of the research that has been done on this topic. It acknowledges that factors other than growth in GDP or Per Capita GDP affect well-being and happiness, but it also shows a relationship between growth in output and measures of well-being. It should stimulate discussions on this important topic.

Saturday, December 22, 2012

President Obama's Politics Are Like Those Of Liberal Republicans In the 1980's

Bill Clinton shifted the Democratic Party to the center right in the 1990's. Barrack Obama's politics are very similar to those of Bill Clinton. The battles that we see in Washington today are like those between moderate Republicans in the 1980's and conservatives in the GOP. There are no moderates in GOP any longer, and there are few liberals left in the Democratic Party. This article explains how politics in the US has become a battle between the far right and the center right. The political spectrum has shifted primarily because of internal changes in the US, and the collapse of socialism in Europe. The Democratic party has worked hard to occupy the center, but the GOP has moved so far to the right that it regards centrist policies as socialism. Social Security, and other other entitlement programs have always been targets for the right wing. Today they are targets for the entire Republican Party. Liberal Democrats are having difficulty with the president's willingness to compromise with conservatives on entitlement spending, and on tax policy, but conservatives are not interested in compromises. They still can't believe that they lost an election to someone who does not share their ideology.

This article was written by a Republican who served in the Reagan administration.

This article was written by a Republican who served in the Reagan administration.

A Comparison Of Medicare Costs Per Enrollee With Private Insurers

There is much debate today in Washington about cutting the cost of Medicare. We would all like to lower the cost of Medicare. Some argue that the best solution is to privatize Medicare and lower costs by having private insurers compete with each other. That would be a good idea if private insurers were better at cost control than Medicare. This article provides the answer to that question. Medicare cost per enrollee is lower the the cost per enrollee in private insurance plans. That is because Medicare is in a better position to negotiate prices with healthcare providers because of its size. Competition between healthcare providers would only weaken the bargaining power of private insurers.

Meet A Tea Party Representative From Kansas

This is a video of a TV interview of a congressman from Kansas who is interviewed by a former conservative congressman, who is now a TV personality. The congressman is concerned that we are politicizing the massacre in Connecticut, when we should be mourning for those who were murdered. That is just what Fox News told its audience. It would be wrong for government to take advantage of that sad event in order to do something to prevent a similar event in the future. It would be a threat to our freedom. The congressman also explained why he, and other Tea Party members of Congress, did not support the plan offered by his party's House Majority Leader to strike a deal with President Obama. He and his colleagues will not support any plan that raises taxes. They firmly believe that taxes are too high today, and that is the reason for high unemployment. Moreover, our budget deficits are the result of overspending on entitlements. We should balance the budget entirely by cutting entitlement spending. I have heard all of this before, but I had never seen a true believer under a TV microscope before. He is totally unshakable in his belief system. There is nothing that anyone could do to dissuade him from his beliefs with disconfirming data. I'm also pretty sure that the folks who voted for him in Kansas think just like he does. It does not matter to him at all that a deal cannot be made without a compromise with those who believe otherwise. He does not even want to compromise with the leadership of his party. They are also the enemy. I think I understand now why the Koch Brothers have located their headquarters in Kansas.

The NRA Offers It's Solution For Mass Murders

In response to the massacre of children in Connecticut with an assault weapon, the CEO of the National Rifle Association called for the use of more guns. He told a national audience that the only way to prevent massacres from happening is to put armed security guards in our schools. He argued that a good guy with a gun will kill the bad guy with a gun. That scenario reminds me of the western movies that I saw as a kid. Everyone was armed with a gun, but the good guys always managed to kill the bad guys. That fantasy is still alive for the NRA and, unfortunately, for many Americans. This editorial does what it can to destroy the fantasy. I doubt that it will be successful.

Thursday, December 20, 2012

Does Marginal Productivty Theory Explain Rising Income Inequality?

Greg Mankiw is the Chairman of Harvard's Economics Department. He also was the Chairman of George Bush's Council of Economic Advisers. He has also written a widely used macroeconomics textbook. His text attempts to explain the distribution of income in terms of marginal productivity theory. The share of income going to wages has been relatively constant, and Mankiw argues that this confirms marginal productivity theory. This article provides an extensive critique of marginal productivity theory as an explanation for the distribution of income. Some readers may want to read the critique of marginal productivity theory. I have selected two graphs from the article which deal with the practical implications of the critique.

This graph (click to enlarge) shows that the relationship between hourly wages and productivity, which is the output per hour of work, shifted sharply around 1980. Real growth in hourly wages have been stagnant, while productivity has continued to increase on its trend line. It is hard to explain this result in terms of marginal productivity theory. Other factors must have led to this result.

The top line on this graph shows that wages income has been relatively constant over time. The second line shows that hourly wages have declined over that period. The third line shows that wages going to supervisor's have risen during this period. The gains from productivity have gone to managers, and executives instead of being shared with hourly workers. It is easier to explain that phenomenon by factors other than the marginal productivity of labor. The wages of hourly workers have more likely been affected by weaker bargaining power. The decline in bargaining power may be related to the decline in unions as well as to globalization and the threat of offshoring jobs to low wage countries. Government policies have also been more favorably aligned with management concerns. Anti-labor legislation, low minimum wage laws and a host of other factors have led to an imbalance of power that undermines wage growth for hourly workers.

This graph (click to enlarge) shows that the relationship between hourly wages and productivity, which is the output per hour of work, shifted sharply around 1980. Real growth in hourly wages have been stagnant, while productivity has continued to increase on its trend line. It is hard to explain this result in terms of marginal productivity theory. Other factors must have led to this result.

The top line on this graph shows that wages income has been relatively constant over time. The second line shows that hourly wages have declined over that period. The third line shows that wages going to supervisor's have risen during this period. The gains from productivity have gone to managers, and executives instead of being shared with hourly workers. It is easier to explain that phenomenon by factors other than the marginal productivity of labor. The wages of hourly workers have more likely been affected by weaker bargaining power. The decline in bargaining power may be related to the decline in unions as well as to globalization and the threat of offshoring jobs to low wage countries. Government policies have also been more favorably aligned with management concerns. Anti-labor legislation, low minimum wage laws and a host of other factors have led to an imbalance of power that undermines wage growth for hourly workers.

Guess Who Is Against Gun Control

We have a political party that either denies global warming, or argues that it is due to natural weather patterns that are not affected by human behavior. The party also believes that we don't spend enough on the military and that we spend too much on education, healthcare, and other social welfare programs. It also opposes progressive taxation, and fights against almost every effort to regulate or supervise the financial services industry. Does it surprise anyone that it defends the recreational use of assault weapons, and repeats every argument used by the NRA against gun control? If we did not have this political party, we would have to invent it so that we could understand how the democratic process can be corrupted.

Wednesday, December 19, 2012

President Obama Will Pursue Several Specific Methods To Control Guns

This article describes the specific plans proposed by the president to limit access to guns and to provide mental health services for people who may be a threat to others.

Another US Army General In Trouble For Sexual Behavior

The unethical and illegal behavior that has been endemic in the international banking community, seems to have invaded the military. This article describes the sexual charges against a US Army General who will face court martial for his adultery with as many as 5 women under his command.

The GOP May Have Ended Fiscal Cliff Negotiations

The GOP House will pass a bill modeled after the House majority leader's proposal. Boehner suggested that the president must either accept the House bill, or the president will be responsible for the tax increases that will result. In other words, the GOP is playing a political game on who the public should blame for the failure of negotiations. The president holds the best hand in this game, as long as he is willing to play his hand. He can let the Bush tax cuts expire, and then the Senate can introduce a bill which reinstates the middle class tax cuts that will expire along with the expiration of the Bush tax cuts. He has not been a tough negotiator in his previous discussions with Boehner right after the 2010 elections when he had a weaker hand. We will have to see what happens next.

Jamie Galbraith On The Global Economic Crisis and What Is Needed To Save Europe

Galbraith delivered this speech to a labor union audience in Germany. He argues that we are witnessing a global economic crisis that has three causes. Energy prices have doubled since the good old days during the thirty years after WW ll. The second factor is the computer revolution which is similar to what happened to horses after the invention of the internal combustion engine. Office workers are being replaced by computers and computers along with the Internet have facilitated globalization. The third factor is ideological. The US and Europe embraced the ideology of free markets. This led to the deregulation and de-supervison of industry. In particular it led to fraudulent behavior of the international banks. This, in turn, destroyed the real estate finance market as well as the public finance market in much of Europe. The sovereign debt on the periphery is perpetual. It will have to be paid off, or written off, and the prospects for paying it off in full are not good.

The US is in a better position than Europe for several reasons. Its automatic stabilizers kicked in and supported unemployed workers. Fiscal policy and monetary policy in the US has also supported the economic recovery. In Europe austerity was imposed on the periphery and monetary policy is not available to them. In the US those who defaulted on their mortgage debt lost their investment, but they are free from their debt when they default. In Ireland, for example, debtors cannot escape from their obligations by defaulting.

Europe has two models for breaking up the eurozone. One is Yugoslavia which led to civil war. The other is Czechoslovakia which did it without warfare. Neither of them were easy. The only alternative for saving the eurozone will require leadership from Germany. Its political leaders have not done a good job of selling the public on what must be done to support the rescue operation. The result of a break up is hard to predict because there is no legal framework to deal with all of the things that will need to be done. It will also be catastrophic for the North as well as for the South.

The US is in a better position than Europe for several reasons. Its automatic stabilizers kicked in and supported unemployed workers. Fiscal policy and monetary policy in the US has also supported the economic recovery. In Europe austerity was imposed on the periphery and monetary policy is not available to them. In the US those who defaulted on their mortgage debt lost their investment, but they are free from their debt when they default. In Ireland, for example, debtors cannot escape from their obligations by defaulting.

Europe has two models for breaking up the eurozone. One is Yugoslavia which led to civil war. The other is Czechoslovakia which did it without warfare. Neither of them were easy. The only alternative for saving the eurozone will require leadership from Germany. Its political leaders have not done a good job of selling the public on what must be done to support the rescue operation. The result of a break up is hard to predict because there is no legal framework to deal with all of the things that will need to be done. It will also be catastrophic for the North as well as for the South.

Growth In Wealth Over 27 Years Very Unequally Distributed

This graph (click to enlarge) depicts the unequal distribution of growth in wealth in the US 1983-2010. Wealth actually declined for the bottom 60% and it barely grew by only 4.3% in 4th quintile. Almost 75% of the growth in wealth went to the top 5%. The top 1% experienced 38.3% of the growth in wealth. (I would guess that the top .01% received the lion's share of growth within the top 1%.

One of the reasons for the maldistribution of growth in wealth is due to the loss of wealth by the bottom 80%. The major asset class in that group is the equity in their homes. Most of that wealth was lost with the bursting of the housing bubble. Those in the top 5% are the major owners of corporate stocks and other securities. That asset class has performed much better over 27 years.

The unequal distribution of wealth contributes to unequal growth in income. Those in the top 5% earn incomes from capital gains and dividends which are not available to most households in the bottom 80%.

One of the reasons for the maldistribution of growth in wealth is due to the loss of wealth by the bottom 80%. The major asset class in that group is the equity in their homes. Most of that wealth was lost with the bursting of the housing bubble. Those in the top 5% are the major owners of corporate stocks and other securities. That asset class has performed much better over 27 years.

The unequal distribution of wealth contributes to unequal growth in income. Those in the top 5% earn incomes from capital gains and dividends which are not available to most households in the bottom 80%.

UBS Pleads Guilty To Rigging Interest Rates

UBS was fined a total of $1.5 billion by US and UK authorities for rigging the Libor interest rate. The Japanese subsidiary, which was most active in the practice, was hit with a criminal charge of fraud. UBS is only one of several major international banks that have been charged with illegal setting of the Libor rate. UBS most recently suffered a $2.3 billion loss by rogue trader.

Tuesday, December 18, 2012

HSBC Is A Criminal Enterprise Protected From Prosecution by Government

This article (via Manan Shukla) is very critical of the decisions by governments in the US and the UK not to prosecute HSBC on criminal charges for money laundering. HSBC acquired one of the worst mortgage originators that engaged in predatory, and fraudulent mortgage origination's, while it was aiding and abetting drug cartels by placing their cash receipts into the banking system. This was done with the consent of the top management. Bank regulators chose not to prevent their criminal behavior, and the US Justice Department chose not to proceed with criminal charges for money laundering and violations of US law. The government defended their action on the grounds that HSBC was too big to prosecute because it would destabilize the fragile banking system. The person in charge of criminal prosecutions for white collar crime in the Justice department even coached bank executives on how to avoid criminal prosecution by taking the position that it would cause the lose of jobs.

One of the major objections to the government's decision is that it encourages other large banks to engage in unethical and criminal behavior. That gives the large banks a competitive advantage over smaller banks that operate ethically and legally. Governments in the US and the UK were also competing for dominance in international banking. They used weak regulation of the banking system as a strategy to help Wall Street and the City Of London to win the race to the bottom. This also corrupts the free market system. Crony capitalism, and the spread of unethical behavior in large corporations is the outcome. It also makes a joke out the war on drugs in the US. The drug cartels could not have operated with help from banks like HSBC.

One of the major objections to the government's decision is that it encourages other large banks to engage in unethical and criminal behavior. That gives the large banks a competitive advantage over smaller banks that operate ethically and legally. Governments in the US and the UK were also competing for dominance in international banking. They used weak regulation of the banking system as a strategy to help Wall Street and the City Of London to win the race to the bottom. This also corrupts the free market system. Crony capitalism, and the spread of unethical behavior in large corporations is the outcome. It also makes a joke out the war on drugs in the US. The drug cartels could not have operated with help from banks like HSBC.

Private Equity Firm Announces Plan To Sell Its Interests In Firearms Firm

Cerebus is a private equity firm with $20 billion under management. It raises capital from pension funds, endowments etc. and it invests the capital in a wide variety of industries. It had acquired the firm that manufactures the weapon used in the Newtown massacre, along with a number of other firearms firms, that were organized in a holding company called the Freedom Group. Cerebus announced that it was in the process of selling its interests in Freedom Group. Cerebus does not believe that it is possible to prevent the misuse of firearms in the Newtown massacre. They made their decision for business reasons. The decision may have been influenced by the announcements by a large pension fund to look into its investments in the firearms industry.

Jeff Sachs Argues That US Economy Requires Something Other Than Keynesian Stimulus

Jeff Sachs argues that the US economy does not suffer from a short term drop in aggregate demand. That is why the US economy was not helped by the Keynesian approach to demand stimulation. He is also critical of monetary policy. He does not believe that low interest rates are a solution, and he also argues that low interest rates helped to create the real estate boom and bust. He believes that structural changes in the economy are our real problem, and that we need a longer term plan to address the structural changes over 20 year period. Policies designed to influence demand over the business cycle are not what the doctor should be ordering.

The post that follows, takes issues with Sachs' arguments against the effectiveness of Keynesian stimulus, and his criticism of monetary policy. Their criticism of Sachs is will taken. I believe, however, that we do have underlying structural problems in the US and in Europe that need to be addressed. In particular, globalization has not been well managed in many of the advanced economies. Some of the investments that Sachs identified are also needed. We do need a plan for dealing many of our problems that go well beyond the business cycle.

The post that follows, takes issues with Sachs' arguments against the effectiveness of Keynesian stimulus, and his criticism of monetary policy. Their criticism of Sachs is will taken. I believe, however, that we do have underlying structural problems in the US and in Europe that need to be addressed. In particular, globalization has not been well managed in many of the advanced economies. Some of the investments that Sachs identified are also needed. We do need a plan for dealing many of our problems that go well beyond the business cycle.

A Critique of Jeff Sach's Dismissal Of Keynesian Policies

These economists argue that Jeff Sachs did not offer empirical evidence to support his conclusion that Keynesian stimulus has not worked, and that austerity has not been a problem in the UK and in Europe. They also argue that Sachs' critique of monetary policy is inconsistent with his attack on Keynesian policies. There is no role for for monetary policy to affect real interest rates in macroeconomic models outside of Keynesian models. Therefore, it is inconsistent to argue that the Fed created low interest rates unless one assumes a Keynesian macroeconomic model.

Residents Of Newtown Connecticut Resisted Gun Control Efforts

There has been a long history of recreational gun use in Newtown. Some residents, and the police, had proposed new regulations that would have been more restrictive. This article describes the views of those who supported the new regulations and the views of those who opposed them. One resident argued that American freedom depends upon the use of guns. He also cited the theme of the NRA in opposition to gun control. Guns don't kill anyone. Crazy people are responsible. It never occurs to avid supporters of the recreational use of guns, that there is a need to prevent crazy people from having access to assault weapons.

Monday, December 17, 2012

How To Raise Tax Revenue From The Right Places

Larry Summers does a good job of locating some of our most costly tax policies, that are only available to the super rich. Messing around with the marginal tax rate on earned income, and deductions from earned income, will not raise as much income as eliminating provisions in the tax code have been written into law primarily for the benefit those who are legally permitted to avoid taxes on capital gains and estate taxes. Closing those loopholes will increase tax revenues while also increasing social welfare.

Democracy only works well when the general public is well informed. We do a very poor job of educating the public about the two most important things that government does. Governments raise money from taxes and they spend that money. We don't educate the public about tax policy, and most Americans are misinformed about what the government does with the money it collects in taxes. That is probably not by accident.

Democracy only works well when the general public is well informed. We do a very poor job of educating the public about the two most important things that government does. Governments raise money from taxes and they spend that money. We don't educate the public about tax policy, and most Americans are misinformed about what the government does with the money it collects in taxes. That is probably not by accident.

How Should We Think About a $1 Trillion Deficit?

A Trillion is a very big number. It is being used to scare people about our need to cut government spending on social security programs that have been important for a large segment of our population. We are told that deficits of that magnitude are unsustainable. One way to think about the problem is look at our personal debt in relation to our income. For most people their mortgage debt is related to their income. The size of their debt is only relevant in terms of their ability to service their debt. Lets suppose that someone with a good credit history has suffered a loss of income. Their ability to service their debt, in the face of lost income, may become a problem as their debt to income ratio increases. They may be able to restructure their debt, however, because their creditors expect their income to return to previous levels. The US has a similar problem. Its debt to GDP ratio has increased for two reasons. Governments lose tax revenues, as GDP falls during a recession, so its debt to GDP ratio increases. Government spending on social insurance programs also increase. That explains around half of the trillion dollar deficit in 2012. Since the government is considered creditworthy, however, the government has been able borrow money from investors to service its debt at low interest rates. As long as the economy improves, and tax revenues increase, the debt to GDP ratio will return to sustainable levels. In the long run, however, government spending, primarily on healthcare, is growing faster than GDP grows even in a good economy. We must bring healthcare spending in line with GDP, and growth in tax revenues, in order to have a sustainable ratio of debt to GDP. Since we have a very inefficient healthcare system, there is a lot of room for improvement. Political gridlock is the only impediment to containing unsustainable growth in the cost of healthcare. It is also standing in the way of the actions that we need to hasten our recovery of the the recession.

Sunday, December 16, 2012

A Nation In Love With Weapons Can't Control Them

The mother who was killed by her son, who then went to school and slaughtered 20 children and 7 adults with an assault rifle, was a gun lover. Too many American's are fascinated by the power of guns, and many of our TV shows titillate their fantasies about guns as a source of power. The deranged person who killed his mother and 27 innocent people was dressed up like a member of SWAT team when he committed his senseless act of fury. Every time something like this happens in America, articles like this are published which argue for controlling the possession on assault weapons and handguns. Fox News suggested that this was not a good time to have a discussion about the control of weapons, and its audience agrees with them. Freedom in America means that government should not interfere with the ability of sick individuals to act out their fantasies. We are told that access to guns is not the problem, people are the problem. We are not told that easy access to guns by sick people is part of the problem. Politicians are afraid to limit access to guns because they will be attacked by the gun lobby, and many American's whose fascination with guns, as a source of power, won't vote for them. The politicians will protect their freedom, and they will do nothing about video games and TV shows that enable the powerless to engage their fantasies about guns as a source of power. They find it easier to tell young people not to engage in sex until marriage, than to it to limit the freedom of any American to possess powerful weapons.

Friday, December 14, 2012

US Treasury Study Explains Why Education Is Important For Mobility and For The Nation

Most families already know the rationale for higher education provided by this Treasury report. Those with college degrees are more likely to earn higher incomes and the economy does better with a better educated work force. The Treasury report recognizes that affordability has become a problem for many Americans and it describes several of the government programs for making higher education more affordable. The thrust of the government programs is to make student borrowing less costly and more available. The Treasury report does not address the problem of declining public spending on higher education. Moreover, much of the borrowed money is wasted on for-profit higher education programs that do not serve the interests of students or the public interest. We would be better off if the government provided funds to states to that are cutting back on education spending than we are when we support student loans that are wasted on for-profit colleges that are not graduating most of the students that they admit.

The UK Government Is Providing Economic Medicine That Is Making The Economy Worse Off

This article, by a former member of the Bank of England, explains why the current economic policy of the Cameron government is only making things worse in the UK. The Cameron government is implementing economic policies that Republicans have proposed in the US. The US has been luckier than the citizens of the UK. Our electorate voted against the policies that UK electorate supported.

Our Biggest Political Problem Is That One Of Our Political Parties Is Out Of Ideas

The GOP is having a mid-life crisis. For thirty years it has been on a crusade to roll back the New Deal and the Great Society programs. Its problem is that these programs are very popular. This is evident in the current negotiations over the fiscal cliff. The GOP pretends to be concerned about budget deficits, but it has not presented a concrete plan to raise tax revenues or to cut spending. Its tax proposal is the same as the one that Romney proposed in his unsuccessful campaign that he lost by over 4 million votes. They want to keep tax rates where they are today, and make unspecified changes in deductions, exemptions and credits to increase revenue. They won't specify the these changes because they know that many are popular with the middle class, and that it is impossible to raise enough tax revenue by cutting deductions for the rich. They want big cuts in government spending, especially in entitlements, but they have offered no plan for doing so. The public, which includes a large part of the GOP base, loves Social Security and Medicare. Many in the GOP base resent Medicaid because it helps out the "wrong" people, but it is also taking care of the elderly in their families. Over two thirds of Medicaid spending is on the elderly poor, which includes the parents and grand parents of many in the GOP base.

The bottom line is that the GOP is out of ideas. It has only two ideas: cut taxes and shrink government. The public does not like taxes, and many would like a smaller government. The GOP's problem is that government needs to raise taxes to deal with budget deficits, and the public does not want to cut Social Security and popular healthcare programs.

The bottom line is that the GOP is out of ideas. It has only two ideas: cut taxes and shrink government. The public does not like taxes, and many would like a smaller government. The GOP's problem is that government needs to raise taxes to deal with budget deficits, and the public does not want to cut Social Security and popular healthcare programs.

Unemployment Costs Government More Than Interest On Its Debt

Robert Reich makes the case for government to focus on job creation instead of on our short term budget deficits. Unemployment is not only painful for those without jobs, it is very expensive for government, and bad for the economy. He is critical of the President for sometimes putting the focus on debt reduction, but I think that the President understands the difference between the short term problem of unemployment, and the need to address longer term budget issues. He knows, however, that he must also be mindful of the longer term issue of debt reduction. Our biggest budget buster is the rising cost of healthcare and the first step in addressing that problem is the ACA. Implementation of ACA my set the stage for a plan more like Canada's single payer system. Our hybrid system is broken.

Thursday, December 13, 2012

David Leonhardt Interviews Paul Krugman

This has a link to a video of an interview with Paul Krugman on economic issues and politics. It covers topics like China, the fiscal cliff, the evolution of the GOP, and what Obama should do. Its well worth watching.

China and India are on a path to becoming the largest economies in the world. Its really pretty simple. They have huge populations and they have access to the same technology as everyone else. Economic growth is a function of population and technology. The US and Europe have been able to mold the global economy in their interests. China will become part of the big three. The only real issue is that we have limited natural resources and growth in Asia will increase competition for natural resources and global warming will occur faster than it its now.

Negotiations around the fiscal cliff and the debt ceiling are limited by the inability of the GOP to come to grips with the lost election. They are in much weaker position than they are ready to accept. Obama can let the Bush tax cuts expire and then he can propose raising taxes for the middle class. The GOP has no defense for that strategy. So far the GOP has been waiting for Obama to propose spending cuts. They have no real plan for cutting spending. Their Tea Party base is as dependent upon Medicare and Medicaid as the Democratic base. It consists of older whites. The GOP has only made weak proposals for changes to popular programs. The most immediate problems faced by the economy are not even on the table as part of the fiscal cliff negotiations.

Somehow the US has to increase revenues and cut the cost of healthcare. Eventually, we will have to move to a single payer system to deal with medical costs and we have to be able to say no to healthcare providers who over medicate and provide more services than we need to be healthy. The GOP base consists of plutocrats and preachers. The plutocrats don't want to ruin the economy and there aren't enough white social issue voters to allow the GOP to win future general elections. They do better in mid-term elections when democrats and plutocrats don't vote.

China and India are on a path to becoming the largest economies in the world. Its really pretty simple. They have huge populations and they have access to the same technology as everyone else. Economic growth is a function of population and technology. The US and Europe have been able to mold the global economy in their interests. China will become part of the big three. The only real issue is that we have limited natural resources and growth in Asia will increase competition for natural resources and global warming will occur faster than it its now.

Negotiations around the fiscal cliff and the debt ceiling are limited by the inability of the GOP to come to grips with the lost election. They are in much weaker position than they are ready to accept. Obama can let the Bush tax cuts expire and then he can propose raising taxes for the middle class. The GOP has no defense for that strategy. So far the GOP has been waiting for Obama to propose spending cuts. They have no real plan for cutting spending. Their Tea Party base is as dependent upon Medicare and Medicaid as the Democratic base. It consists of older whites. The GOP has only made weak proposals for changes to popular programs. The most immediate problems faced by the economy are not even on the table as part of the fiscal cliff negotiations.

Somehow the US has to increase revenues and cut the cost of healthcare. Eventually, we will have to move to a single payer system to deal with medical costs and we have to be able to say no to healthcare providers who over medicate and provide more services than we need to be healthy. The GOP base consists of plutocrats and preachers. The plutocrats don't want to ruin the economy and there aren't enough white social issue voters to allow the GOP to win future general elections. They do better in mid-term elections when democrats and plutocrats don't vote.

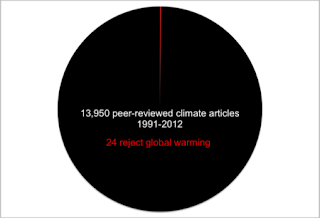

What Scientific Debate About Climate Change??

Friends of the fossil fuel industry like to talk about the debate within the scientific community about climate change. This graph shows that skeptics are a rare breed. Only 24 out of 13,940 peer reviewed articles about climate change reject the idea that the earth is warming. They get a lot of coverage from the usual suspects that work for Rupert Murdoch's media empire, and inform the Tea Partier's in the US.

Wednesday, December 12, 2012

Putting The HSBC Fine In Perspective

This article (via Manan Shukla) puts another perspective on the HSBC fine. It was embarrassing for it to get caught breaking the law, but it was good business while it lasted. The amount of the fine is small relative to its assets and its income. It is not good deterrent. That is one reason why big banks continue to do bad things.

White House Asking CEO's For Permission To Raise Their Taxes

This article describes the efforts by the White House to enlist the support of top business executives in the battle over tax reform. Some who support higher taxes believe that it is the only way to get support from the administration to cut entitlement benefits. A letter from the Business Roundtable, which is an organization of F500 CEO's, suggested that entitlement cuts should be a multiple of the increase in taxes. That has been the GOP position all along. The president has taken the position that tax increases should be a multiple of spending cuts. Its hard to see what he has gained by seeking permission from CEO's to let the Bush tax cuts expire for them expire under current. The Bush tax bill was passed by Congress, under the condition that they be temporary, precisely because of their impact on budget deficits. Letting the tax cuts expire is now being portrayed as a major increase in taxes.

Libertarians, who claim that government is a threat to their personal liberty, should be encouraged by the White House's effort to seek permission from CEO's to raise their taxes. This is a far cry from the tyranny that they scream and holler about. When FDR signed the income tax bill during the Great Depression, he said that it was for the newspaper tycoon Randolph Hearst, whose papers opposed the income tax bill.

Libertarians, who claim that government is a threat to their personal liberty, should be encouraged by the White House's effort to seek permission from CEO's to raise their taxes. This is a far cry from the tyranny that they scream and holler about. When FDR signed the income tax bill during the Great Depression, he said that it was for the newspaper tycoon Randolph Hearst, whose papers opposed the income tax bill.

HSBC Fined $1.9 Billion For Money Laundering

This article (via Manan Shukla) describes the money laundering charges against Britain's largest bank. This fine is on top of another fine that HSBC and other banks paid for manipulating the interest rate that banks charge each other for short term borrowing.

Money laundering is a felony. If the US Justice Department successfully prosecuted HSBC on money laundering it would have been prevented from operating its business in the US and it would have had more difficulty borrowing money because many pension funds are not permitted to lend money to banks that have committed a felony. HSBC is also large enough to be a systemic risk to the global financial system. Consequently, the US Justice Department accepted a less plea from the bank.

Money laundering is a felony. If the US Justice Department successfully prosecuted HSBC on money laundering it would have been prevented from operating its business in the US and it would have had more difficulty borrowing money because many pension funds are not permitted to lend money to banks that have committed a felony. HSBC is also large enough to be a systemic risk to the global financial system. Consequently, the US Justice Department accepted a less plea from the bank.

Tuesday, December 11, 2012

MIchigan Passes Legislation Against Unions

Michigan's GOP legislature passed legislation that the GOP calls the "right to work". What it really means is that workers have the right to work without support from unions. Some call it the right to work for less money. This is just another political move to weaken the ability of organized labor in negotiations with managements. This is one of the reasons for increasing income inequality in the US.

Monday, December 10, 2012

Patient Centered Medical Homes

This notice is from my family doctor's office. It describes the Patient Centered Medical Homes concept that was developed by family practitioners. My doctor's practice has agreed to be part of this reform movement, which has a mission to improve quality of service and to better coordinate medical care between one's family doctor and specialists.

An Easy Way To Cut Medicare Costs

This article describes the practices of a for-profit hospital chain which uses software applications to increase hospital admissions from those using emergency room services. It also describes how criminals submit false claims to Medicare. Medicare fraud in Florida is larger than the cocaine trade in Florida. Part of the problem is that Medicare is understaffed. It could easily reduce avoidable hospital charges and fraud by investing in better control systems. Law enforcement also needs to be improved. There is no reason why those engaged in fraud can continue to avoid arrest.

There Has Been A Strong Recovery From Recession For The Well Off

Output per worker in the US in increased but wages declined. That is because all of the growth in income went to the top 10%. There was even greater inequality within that group. The top 1% received 93% of the growth in income. There are lots of explanations for this result but clearly the loss of labor power is part of the explanation. The decline in union membership, and the threats by many firms to export jobs overseas, unless they receive wage concessions, is part of the explanation. Lower wages mean higher profits and an increasing return on capital. The GOP is working hard to weaken the bargaining power of labor even further. Public employee unions are the largest remaining unions in the US. GOP governor's and legislatures are doing what they can to reduce their membership and negotiating power as well. Unless we address the power imbalance in the US, wages will continue decrease as a share of national income.

Lindsey Graham Caught Spreading Lies About Entitlements

Lindsey Graham is the other Senator from South Carolina. He is not a full fledged member of the Tea Party, as was the other Senator from South Carolina, who is is now adding his brain power to The Heritage Foundation. On the other hand, Graham spreads the same lies about entitlements that are common within the GOP. The Washington Posts "Fact Checker" reviews Graham's claims about the pending bankruptcy of Social Security, Medicare and Medicaid and it gives him a failing grade on truth telling. Graham certainly knows the same things that Fact Checker explains about the entitlements, but he has chosen to lie about them.

Disney Has A Monopoly On Bowl Games This Year

Disney/ESPN owns the rights to 32 of the 35 bowl games on TV this year. The major networks have only one bowl game each. Disney/ESPN, in turn, sells its services to cable and satellite providers. If you want to watch one of the games provided by ESPN you need to have cable or satellite services. ESPN makes them more valuable, and it enables ESPN to get higher prices from them when they negotiate contracts.

Robots and Robber Barons

Krugman doubles down on his previous op-ed, in which he offered an explanation for the increasing share of national income that is going to capital, relative to labor's share of income. He has added monopoly to his list of things responsible for the shift. Robots have replaced expensive labor and industry concentration has increased profits. The comments were especially interesting. There were not many comments by conservative trolls who object to his politics. Most were sympathetic to his view and many wondered why it took him so long to figure this out.

Sunday, December 9, 2012

Paul Krugman Has Changed His Mind About An Important Problem

As labor gets more expensive in developing countries, some firms are shifting production back to developed countries. This will only have a small impact, however, on job growth because a lot of the intermediate products that are assembled into final products are made with robots. This caused Krugman to rethink some of his assumptions about the causes on income inequality. Economists have assumed that those with more education and better skills are awarded a skill based premium in the labor market, and that is responsible for income inequality. We should address income inequality by expanding educational opportunity. He then looks at a graph that shows that wage compensation has been a shrinking share of income for the last several years. More of the income has been going to owners of capital. That implies that the ownership of capital may be a determinant of income inequality. That will limit economic opportunity because capital is passed on from one generation to another. Reducing or eliminating estate taxes has amplified that problem. This is new territory for economists who explain income inequality on differences in educational attainment.

I posted an article yesterday on the differences in income between hedge fund managers and full professors at Harvard. Five hedge fund managers employed by the Harvard endowment, earn almost as much as the total income of 450 full professors at Harvard. It is hard to explain that kind of income difference by appeals to the lack of education or skills among Harvard's illustrious faculty. Hedge fund managers have a unique set of skills. They know how to make money by betting on changes in asset prices, and by leveraging those bets with borrowed money. We reward those skills more than we do the skills of those who create knowledge, and pass on knowledge to future generations. We also reward those who are skilled at forming a business based upon the inventions of scientists or engineers who created the knowledge that was essential for the development of products and services provided by the business. The founders of the business end up owning a valuable asset. The scientists and engineers may get a small share of the equity and a good salary. Betting on asset price changes, or the ownership of appreciating assets, is the path to high incomes and wealth.

It is also easier to get rich by purchasing assets at low prices than it is by building a business through one's labor. That is how the oligarchs in Russia got rich, and that is how many got rich through the ownership of natural resources that they acquire from governments at below market prices.

This discussion about income, and the acquisition of wealth, raises serious questions about the assumption in economics that income growth is closely related to growth in social welfare.

I posted an article yesterday on the differences in income between hedge fund managers and full professors at Harvard. Five hedge fund managers employed by the Harvard endowment, earn almost as much as the total income of 450 full professors at Harvard. It is hard to explain that kind of income difference by appeals to the lack of education or skills among Harvard's illustrious faculty. Hedge fund managers have a unique set of skills. They know how to make money by betting on changes in asset prices, and by leveraging those bets with borrowed money. We reward those skills more than we do the skills of those who create knowledge, and pass on knowledge to future generations. We also reward those who are skilled at forming a business based upon the inventions of scientists or engineers who created the knowledge that was essential for the development of products and services provided by the business. The founders of the business end up owning a valuable asset. The scientists and engineers may get a small share of the equity and a good salary. Betting on asset price changes, or the ownership of appreciating assets, is the path to high incomes and wealth.

It is also easier to get rich by purchasing assets at low prices than it is by building a business through one's labor. That is how the oligarchs in Russia got rich, and that is how many got rich through the ownership of natural resources that they acquire from governments at below market prices.

This discussion about income, and the acquisition of wealth, raises serious questions about the assumption in economics that income growth is closely related to growth in social welfare.

The Implications Of A Zero Growth Society

The Great Recession has focused our attention on restoring economic growth as a means to creating jobs. There is a conflict, however, between our efforts to restore growth, and our need to address the dangers from global warming. This article describes the implications of global population growth, and it argues that our planet cannot provide the standard of living enjoyed today in Australia, for the world's population in the future. It also argues that greening the economy will only make a small dent in addressing the problems that we face as the planet continues to warm. Only a zero growth policy can reverse the warming of our planet. That will require a radical change in society that will be difficult to accept. The emerging economies of China, India, Brazil, Russia etc. want the same levels of consumption that the rich nations of the world enjoy today. That is more than our ecology can provide. Our global consumer culture, and the nature of our economic system is predicated on constant economic growth. In order to address the problem of global warming we will need a different culture and a different economic system.

Some may argue about the limits to growth described in this article. Some may also resist the need for the radical changes in the economy that would be required to achieve zero growth. This article, however, provides a good starting point for a discussion about what would be required if the limits to growth, which are described in this article, are reasonable projections for the future. Capitalism is based upon the concept of unlimited growth. Firms sell things to make a profit so that they can make investments which enable them to sell more things. Firms borrow money in order to make investments which require them to pay interest, on top of the principle that they borrowed. They must produce output which has more value than the amount that they borrowed in order to prosper, according the analysis provided in this article. A zero growth society would not be easy to achieve. On the other hand, starting out with the assumptions in this article forces us to deal with much deeper problems than are common among those concerned about global warming.

Some may argue about the limits to growth described in this article. Some may also resist the need for the radical changes in the economy that would be required to achieve zero growth. This article, however, provides a good starting point for a discussion about what would be required if the limits to growth, which are described in this article, are reasonable projections for the future. Capitalism is based upon the concept of unlimited growth. Firms sell things to make a profit so that they can make investments which enable them to sell more things. Firms borrow money in order to make investments which require them to pay interest, on top of the principle that they borrowed. They must produce output which has more value than the amount that they borrowed in order to prosper, according the analysis provided in this article. A zero growth society would not be easy to achieve. On the other hand, starting out with the assumptions in this article forces us to deal with much deeper problems than are common among those concerned about global warming.

More On Jim DeMint's Performance In The Senate

Foreign Policy joins the chorus of those who bid a welcome goodbye to DeMint's exit from the Senate. The Heritage Foundation, that he will now head, gave him a 99% favorable rating while he was in the Senate. This article describes his positions on bills that he opposed in the Senate. We should remember that representatives from Heritage are among the most frequently quoted in the media on policy issues, and they appear often on the Sunday TV News shows.

Saturday, December 8, 2012

Michigan Following Wisconin's Lead Agains Labor Unions

Michigan has a GOP governor and a GOP legislature. This article describes the politics of the "right to work" law in Michigan. The GOP is not only for the wealthy, it opposes the rights of working Americans to organize. The result is organized business against unorganized labor.

Is Harvard A University Or A Hedge Fund?

This article suggests, that from an economic perspective, Harvard is a giant hedge fund with a college attached to it. Harvard employs a number of hedge funds to manage its endowment. Their 5 hedge fund managers earned $78 million in one year. Their average income from Harvard was $16 million. Harvard has 450 full professors who earned slightly more than Harvard's 5 hedge fund managers. They earned $85 million in one year. Their average income was $188,000. They also were taxed at a higher rate than the hedge fund managers.

There are some lessons to be drawn from these data. Harvard's full professors are very smart and accomplished in their fields. I would assume that they make a significant contribution to society. They create new knowledge, and they prepare our future leaders. Harvard's faculty attract top students from all over the world, and its graduates are the primary contributors to its endowment. Harvard's faculty also bring in research grants to fund its graduate programs. Their compensation, however, pales in comparison to that of the hedge fund managers who are compensated for their ability to make winning bets in asset markets. That is primarily a sum zero game. Society derives little benefit from that game. The bets that they win are some other investor's losses. They make a big contribution to Harvard's endowment when they have a good year, but Harvard's endowment suffers more than they do when they have a bad year. They have a much better financial deal than Harvard's faculty, which is responsible for Harvard's brand, and whom make a more substantial contribution to society. Something is wrong with this picture. It also should not be surprising that so many of our most talented students are attracted to careers in the financial industry. We reward talented gamblers more than we do talented professors who add value to society.

There are some lessons to be drawn from these data. Harvard's full professors are very smart and accomplished in their fields. I would assume that they make a significant contribution to society. They create new knowledge, and they prepare our future leaders. Harvard's faculty attract top students from all over the world, and its graduates are the primary contributors to its endowment. Harvard's faculty also bring in research grants to fund its graduate programs. Their compensation, however, pales in comparison to that of the hedge fund managers who are compensated for their ability to make winning bets in asset markets. That is primarily a sum zero game. Society derives little benefit from that game. The bets that they win are some other investor's losses. They make a big contribution to Harvard's endowment when they have a good year, but Harvard's endowment suffers more than they do when they have a bad year. They have a much better financial deal than Harvard's faculty, which is responsible for Harvard's brand, and whom make a more substantial contribution to society. Something is wrong with this picture. It also should not be surprising that so many of our most talented students are attracted to careers in the financial industry. We reward talented gamblers more than we do talented professors who add value to society.

Why Trade Liberalization Is Not The Road To Job Creation

David Ignatius argued that trade liberalization might enable the US to rebalance its budget, and create jobs through growth in exports. Paul Krugman quashes that argument in this article. In the first place there are few barriers today in international trade. There is not much left to do that would expand trade. Moreover, we have lots of wasted resources in the US that are not the result of inefficiency at the micro-economic level. We need a macroeconomic response to high unemployment. He also reminds us that further trade liberalization will also lead to more imports. We can't create enough new jobs through export growth, that would compensate for jobs lost through import growth, to bring the economy back to full employment.

Friday, December 7, 2012

A Preview Of Jim DeMint's Heritage Foundation

The Heritage Foundation under Jim DeMint may reflect his deep thinking on political and social issues. In other words, it will be on its way to becoming a post-thought think tank. In case anyone wonders what a post-thought think tank will advocate, this article provides several examples of DeMint's post-thought ideas. They made him the people's choice in South Carolina. Heritage may have to recruit its post-thought "scholars" from DeMint's home state. They are easy to identify because they have confederate flags in their front yards.

Going Beyond Carbon Dioxide

We seem to be politically blocked by fossil fuel industries from reducing carbon emissions. There are things that Obama can do to reduce the impact of other gases that contribute to global warming. We should not give up on carbon emissions, but the president can demonstrate his ability to lead, and also mitigate climate change, by going after some the low hanging fruit that is available to him, while he sets the stage for more control over carbon emissions.

What Does DeMint Selection To Head Up Heritage Foundation Imply?

There have been two competing explanations for Romney's defeat in the last election. One view is that he was perceived as too conservative, especially by minority voters. The other view, popular within the Tea Party, is that he was not conservative enough. The Heritage Foundation's new CEO believes that the GOP is not conservative enough. He plans to push the Tea Party version of populism at Heritage. This may further split the GOP between populist conservatives like DeMint, and the establishment conservatives who have written the big checks for Heritage in the past.

Thursday, December 6, 2012

Why Did A Billionaire With A Liberal Ideology Give $150 Million To GOP Candidates?

A billionaire casino owner supported Newt Gingrich in the GOP primaries. He switched to Romney after he beat Gingrich in the primary campaign. In a recent interview he described his political views which are further to the left than those of many democrats, and light years away from those of the GOP. He is being investigated for some of his policies the operation of his casinos, and in his efforts to get a foreign license. It seems easier to explain his support for the GOP in terms of favors that he might have anticipated for the candidates that he supported.

Reforms To Medicare Have Many Unintended Consequences

Ruth Marcus describes some of the proposed changes to Medicare. They are intended to reduce the cost of Medicare but they shift the cost to other government programs and to individuals who can least afford them. Some of them even reduce tax revenue. Reforming a complex program like Medicare is like pealing an onion. One change leads to a complex of other changes.

Joe Stiglitz Talks About The Good News From The 2012 Election And His Hopes For Future

There were several positive results from the 2012 election which Stiglitz cites in this article. We avoided disaster, but we have much more to accomplish. He anticipates that we will muddle through, but he does not have high expectations about what might be accomplished.

Fiscal Policy In Britain Expected To Focus On Austerity Through 2018

George Osborne, Britain's Chancellor of the exchequer, stated that Britain's austerity program will continue through 2018. The economy faces another downturn, but Osborne argues that it would be wrong to turn back against it fiscal policy. If the economy remains in the doldrums much longer, his government may not get the opportunity to continue with its restructuring policies.

Jim DeMint Resigns From Senate To Lead Heritage Foundation

Jim DeMint, is a conservative senator from South Carolina who has been one of the leaders of the Tea Party movement. He resigned from the Senate to become the CEO of the Heritage Foundation. He will have a staff of 275 and a budget of $82.4. The Heritage Foundation has a mission of developing conservative ideas and selling them to Congress and to the public. DeMint should be effective in developing relationships between Heritage and Congress. Rush Limbaugh is also a member of the Heritage Foundation. He has been effective in communicating Heritage sponsored ideas to the public.

Donations to the Heritage Foundation are tax deductible. It is classified as an educational institution, even though its mission is to promote a specific ideology, which primarily serves one of our political parties. There are several conservative "think tanks" which have a similar mission. The Heritage Foundation is one of the leaders in this group of conservative think tanks that are funded by charitable donations that can be deducted from the income tax.